Firstcard Secured Credit Builder: Annual Fees, Main benefits and other services

In the financial world of the United States, building or rebuilding credit can be challenging, especially for those starting out or recovering from a bad history. It is in this scenario that the Firstcard Secured Credit Builder stands out, offering an effective and affordable tool to help consumers strengthen their credit score. With a practical and inclusive proposal, this card is gaining prominence. In this article, you’ll find out everything you need to know about it.

Advertising

How to Apply for the Firstcard Secured Credit Builder Card

Applying for the Firstcard Secured Credit Builder is a simple and straightforward process, designed to make life easier for the consumer. The application is made entirely online, with no need to travel, which makes the experience more practical and agile. To help you understand each step, here is a detailed guide on how to apply:

- Access the official website: Go to the official Firstcard Secured Credit Builder page using a secure browser on your computer or smartphone.

- Click on the application option: Look for the “Apply Now” or “Request Card” section on the website. The button will usually be highlighted on the home page.

- Fill out the form: Enter your personal information, such as full name, address, monthly income and Social Security Number (SSN). This information is essential for processing your application.

- Choose the amount of the security deposit: The security deposit will be used as your credit limit. Choose an amount that is within your budget and meets your financial needs.

- Send the requested documents: If necessary, attach additional documents, such as proof of income or ID. Make sure the files are legible and up-to-date.

- Review and submit the application: Before finalizing, review all the information you have provided to ensure it is correct. After confirming, click on “Submit” to complete your request.

Advertising

Once submitted, you will receive an email confirming that the order has been received. This process is accessible and includes clear steps to ensure that all consumers can apply for the card with ease and confidence. What’s more, by following these steps, you’ll already be on your way to building or improving your credit efficiently.

What is the Waiting Time for Card Approval?

One of the positive points of the Firstcard Secured Credit Builder is the speed of the approval process. After submitting the online application, you usually receive a response within 2-3 working days. If approved, the card is sent to the address provided in around 7 to 10 working days. In other words, you can start using it within two weeks.

Advertising

How do I unblock my card?

Once you have received your card, unlocking it is quick and easy. Simply access the card’s official app (more details on the app in the section below) or call the customer service number provided in the welcome kit. In a few minutes, the card will be activated and ready to use.

Advantages the Card Offers

The Firstcard Secured Credit Builder has a range of advantages that make it ideal for those looking to build credit. Here are some of the main benefits:

Credit Building: Monthly reports are sent to the three major credit bureaus (Equifax, Experian and TransUnion), helping to build or improve your score.

Easier Approval: Less stringent requirements make the card accessible to a wider audience.

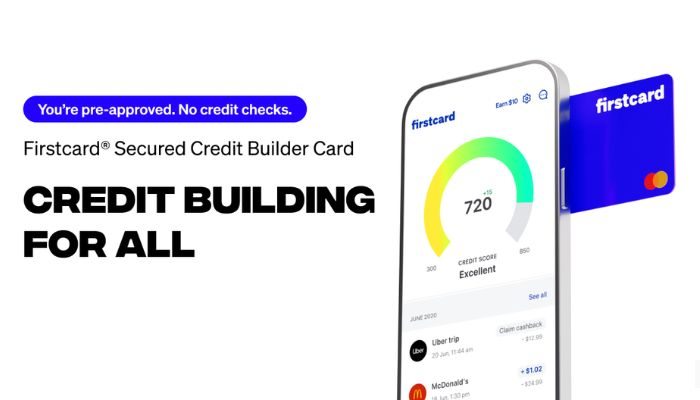

Simplified Management: Through the app, you can keep track of your expenses, payments and balance in real time.

Flexible Limit: The limit is based on the amount of the security deposit, giving you freedom of choice.

What are the card’s interest rates?

Firstcard Secured Credit Builder’s interest rates are competitive with other secured cards on the market. However, it is important to check the exact details at the time of application, as the annual percentage rate (APR) can vary depending on the applicant’s credit profile. In addition, the card has no hidden fees, and you will be clearly informed of any additional costs, such as maintenance fees.

Firstcard Secured Credit Builder App and How to Download It

The official card app is available for iOS and Android. To download it, follow these steps:

- Go to your smartphone’s app store (App Store for iPhones or Google Play for Android devices).

- Search for “Firstcard Secured Credit Builder”.

- Click on “Install” and wait for the download to complete.

- Open the app and log in with your credentials, which will be provided during the application process.

With the app, you can manage your card easily and securely, from tracking transactions to paying invoices.

Does the card have a points program?

Currently, Firstcard Secured Credit Builder does not offer a points or rewards program. The card’s main focus is on helping users establish a good credit history. However, over time, it is possible that the issuer will introduce loyalty programs or additional benefits.

How to Check Your Card Bill

Checking your bill is simple and can be done in different ways:

By App: Access the “Invoices” section in the official app.

By e-mail: You will receive a monthly notice summarizing your invoice.

On the Official Website: Log in to your account and view your payment information directly.

How to request a duplicate of this card

If you lose or damage your card, requesting a duplicate is easy. Simply contact customer service by phone or log in to your account online. There is usually a fee for reissuing, but you will be informed of the amount before you complete the request.

Contacting the Card

If you have any questions or need support, Firstcard Secured Credit Builder customer service is available through the following channels:

- Telephone: A toll-free number will be provided on the website or in the welcome kit.

- Online Chat: Available on the official website.

- E-mail: Send a message to the support address indicated in the app or on the website.

Firstcard Secured Credit Builder is a powerful tool for anyone wishing to strengthen their credit in the United States. With clear advantages, an accessible process and a focus on financial education, it offers a reliable path to better financial health. Whether you’re new to the world of credit or looking to start over, this card is a solid choice.