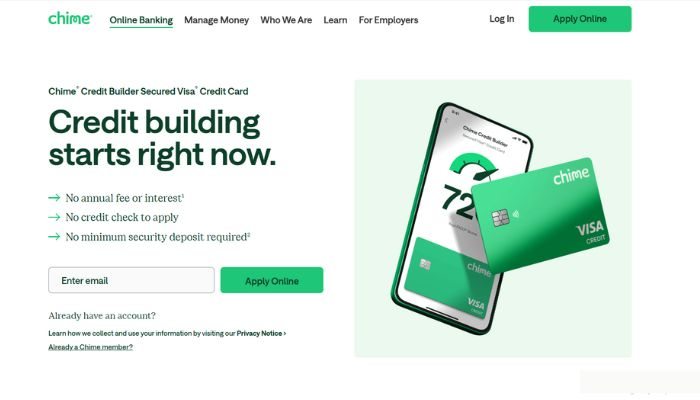

Discover Chime Credit Builder Secured: How to apply, Main benefits and other services

Chime Credit Builder Secured was developed to democratize access to credit in the United States, enabling everyone – especially those outside the traditional banking system – to take an important step towards a healthy financial future. When applying for the card, the customer only needs to make a deposit that will serve as collateral.

Advertising

This amount determines the credit limit, creating a direct relationship between what is saved and what can be spent. In addition to avoiding abusive fees, the card’s main mission is to help build credit history in a safe and educational way, offering users tools that allow them to monitor their spending and, together with responsible use, improve their score.

How to Apply for the Chime Credit Builder Secured Card – Step by Step

Advertising

Applying for the card is simple and quick, designed to eliminate the complications common with other financial products. Below is a detailed step-by-step guide to get you started:

- Visit the Website or Download the App: Start your journey by visiting the official Chime website or downloading the “Chime” app from the App Store or Google Play. Look for the “Credit Builder Secured” option to find specific information about the product.

- Fill in the Application Form: On the portal, you will find an intuitive form. Fill in all the fields carefully, entering personal details, address, income and other information requested. It is essential that the data is correct to speed up the analysis of your profile.

- Send Necessary Proof: In some cases, you may be asked to send documents proving your identity and income. Prepare digital copies of your identity card, proof of residence and, if necessary, bank statements. This step guarantees the security and verification of the data.

- Make the Security Deposit: To release your limit, you must choose a deposit amount, which will serve as a guarantee for the card. This amount will be the basis for the credit limit released and will help create a positive history as you make payments.

- Confirmation and Data Review: Before finalizing the application, review all the information you have entered. Make sure it is up-to-date and free of errors. A careful review can avoid problems in the analysis of your application.

- Submit the Application and Wait for Analysis: After confirming the data and making the deposit, submit the application. Chime’s automated system will carry out a quick assessment of your profile. You will usually receive a response within a few working days.

This process, as well as being unbureaucratic, ensures that even those with a limited credit history can have a fair chance of rebuilding or strengthening their financial credibility.

Advertising

What is the Waiting Time for Card Approval?

Agility is one of Chime’s great differentials. After submitting the application and the necessary documents, approval is usually notified within a few working days. This speed is the result of an automated system that analyzes your profile without the obstacles of traditional banks. For those who want to get their financial life in order as soon as possible, a quick response allows you to plan and use the product immediately, without long waits that could jeopardize your financial plans.

How to Unblock the Card

Once you’ve been approved and physically received your card, the next step is to activate it so it can be used. Unlocking is simple:

- Via the app: When you log in to the Chime app, you’ll find an option to register and activate the card. Follow the on-screen instructions, which usually involve confirming a security code.

- Via the Customer Portal: If you prefer, you can access your account on the official Chime website and activate the card via the “Card Management” area. Simply confirm your details and follow the instructions.

This process has been developed so that even users who are less familiar with the technology can activate their product without complications.

Advantages Offered by the Card

The Chime Credit Builder Secured card offers a series of benefits that set it apart from conventional cards:

- Responsible Credit Building: By using the card responsibly and monitoring your spending, you gradually improve your credit score.

- Total Transparency: With no hidden fees or abusive charges, the card provides clarity at every stage of its use.

- Accessibility for Everyone: Even with a limited banking history, the product offers a real chance of inclusion in the financial system.

- Financial Education Tools: The app and portal provide content that helps in better managing your personal budget.

- Security and Simplicity: With the deposit guarantee, risk is minimized, creating a safe environment for all transactions.

These advantages make the Chime Credit Builder Secured card a smart choice for those who want to build a solid financial history.

What Are the Interest Rates on the Card?

One of the biggest concerns when acquiring any credit card is the interest rates. In the case of Chime Credit Builder Secured, the deposit-based model ensures that rates are much more competitive, since the credit risk is tied to the amount deposited.

This methodology contributes to the fact that, compared to traditional cards, interest rates are considerably lower, making the use of the product a safer and more economical option for building credit. However, it is always recommended that you carefully read the terms and conditions to understand all contractual details.

Chime App and How to Download

Managing your card becomes even more practical with the Chime app, which was developed to offer a fluid and complete experience. In the app, you can:

- Check your balance and see detailed transaction statements.

- Unblock cards and request duplicates.

- Receive real-time notifications about your spending and account updates.

- Access educational content and financial education tips.

To download it, simply search for “Chime” in the App Store (iOS) or Google Play Store (Android). The app is free and easy to use, designed to let you track your financial progress with every tap.

Points Program?

Unlike many conventional cards that accumulate points for redemptions on airline tickets or discounts, Chime Credit Builder Secured focuses on improving your credit history. By using it responsibly, the main “gain” is the increase in your score, which opens the door to better conditions in future financing and loans. Thus, the return on your investment is in building a healthy relationship with credit, and not in accumulating points that may have limited usefulness.

How to Check Your Card Statement

Keeping track of expenses is essential for those who want to improve their financial education. With Chime Credit Builder Secured, checking your statement is practical and simple:

Through the App: Access the “Statement” or “Statement” menu to view all transactions made, organized by date and category.

On the Online Portal: Once logged into your account, you can navigate to the area dedicated to your invoice, where you will find details of each purchase. This transparency allows you to identify possible undue charges and monitor your financial progress in real time.

How to Request a Duplicate Card

Unforeseen events happen, and if your Chime Credit Builder Secured card is lost, stolen or physically damaged, requesting a duplicate is quick and easy. Simply:

- Access the app or the official website.

- Go to the “My Account” or “Card Services” section.

- Select the “Request Duplicate” option.

- Confirm your details and address so that the new card can be sent to the registered location.

This procedure ensures that you will not be interrupted in the use of your financial features, keeping your spending flow and control up to date.

Contact and Customer Support

Chime’s customer support is renowned for its efficiency and friendliness. If you have questions or need assistance at any stage, you can:

- Use the In-App Chat: A quick option to resolve specific questions.

- Send an Email: Communicate directly with the support team.

- Call the Customer Service Center: Get personalized assistance over the phone.

These channels have been structured to offer quick responses and personalized service, ensuring that your questions are treated with due attention and clarity.

Chime Credit Builder Secured presents itself as a complete and affordable solution for Americans looking to build a solid financial history. With a simplified application process – detailed in our step-by-step guide –, a reduced approval time and features that make it easier to manage the card, this product goes far beyond a simple payment method.