Milestone Card: Your Path to Building Credit

The Milestone Mastercard is issued by The Bank of Missouri, an FDIC-insured financial institution based in St. Robert, Missouri. This bank has partnered with Concora Credit, which manages the card services and customer support operations.

Advertising

The Milestone Card is designed specifically for individuals with challenging credit backgrounds who want to build a solid financial foundation. Unlike many traditional credit cards that require excellent credit scores, the Milestone Mastercard welcomes applications from individuals with fair or poor credit.

Advertising

The application process is entirely online, and one attractive feature is that you can check if you pre-qualify without any impact to your credit score. This means you can explore your options without worrying about hard inquiries that might temporarily lower your credit rating.

Step-by-Step Guide to Apply for the Milestone Card

Applying for your Milestone Mastercard is straightforward and can be completed in just a few minutes. Here’s exactly what you need to do:

Advertising

Getting Started: Visit the official website at milestonegoldcard.com and click the “Apply Now” button. If you received a promotional offer in the mail with a specific code, have that ready as it may provide better terms.

Required Information: The application will ask for your personal information, including your full name, date of birth, Social Security number, current residential address, and contact details. You’ll also need employment information, including your employer’s name, occupation, and annual income.

Approval and Activation: After submitting your application, you’ll typically receive a decision within minutes. If approved, your new card will be mailed within 14 business days. Once you receive it, activate it by calling 1-800-305-0330 or visiting the activation page online.

The Card’s Network Brand

The Milestone Card operates on the Mastercard network, one of the world’s largest payment networks. Your card will be accepted at millions of merchant locations across the United States and in over 210 countries worldwide.

Whether you’re shopping online, at your local grocery store, or traveling, you can use your Milestone Card wherever you see the Mastercard logo. The card includes chip technology for enhanced security and contactless payment capability for convenient transactions.

Card Fees and Charges

Understanding the fees associated with the Milestone Card is crucial for managing your account effectively. Here’s a breakdown of the main costs:

Annual Fees:

- First year: $175

- Subsequent years: $49

The annual fee is charged when your account opens, reducing your available credit immediately. For example, with a $300 credit limit, after the $175 fee is deducted, you’ll have $125 available.

Interest and Other Charges: The regular purchase APR is 35.9%, making it important to pay your balance in full each month to avoid interest charges. Additional fees include late payment fees, returned payment fees, and over-limit fees up to $41 each. There’s also a 1% foreign transaction fee for purchases outside the United States.

Understanding the Milestone Card Experience

The Milestone Mastercard serves as a tool for people who have experienced financial setbacks or are beginning to establish their credit history. Unlike secured credit cards that require an upfront security deposit, this is an unsecured card, meaning you don’t need to put down any money.

The card comes with a modest credit limit, typically $300 to $700. While this might seem small, it’s intentional to help you manage spending responsibly while building credit history. The Bank of Missouri reports your payment activity to all three major credit bureaus – Equifax, Experian, and TransUnion.

Key Benefits of the Milestone Mastercard

The Milestone Card offers several important advantages for cardholders:

Credit Building Features:

- Reports to all three major credit bureaus

- No security deposit required

- Accessible approval for challenged credit histories

- Helps establish positive payment history

Protection and Security:

- $0 fraud liability protection through Mastercard

- Mastercard ID Theft Protection monitoring

- Chip card technology for secure transactions

- Protection against unauthorized charges

Account Management:

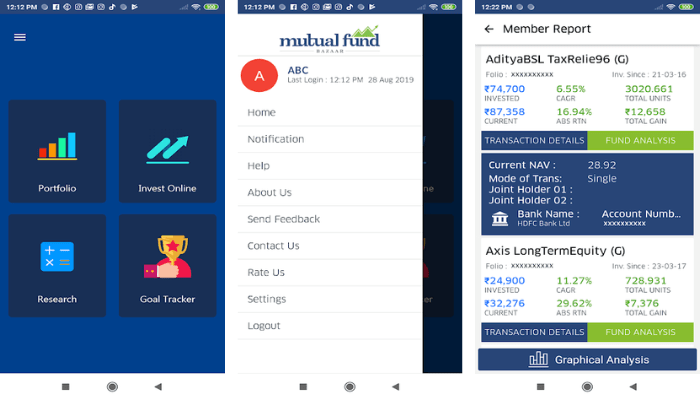

- 24/7 online account access

- Mobile app for convenient management

- Track credit-building progress

- Easy payment options

Every on-time payment is reported to credit bureaus, helping establish or rebuild your credit profile. This can be invaluable for people who have had past financial difficulties or are new to the U.S. credit system.

Downloading the Milestone Card Mobile App

Managing your Milestone Card is easy with the mobile application. Visit the App Store for iPhone/iPad or Google Play Store for Android devices. Search for “MyMilestoneCard” or “Milestone Mastercard” and download the official app from Concora Credit.

After installation, register your account using your account number, date of birth, and Social Security number. Once registered, you can view your balance, see transactions, make payments, set reminders, and track your credit-building progress from your smartphone.

Requesting a Replacement Card

If your Milestone Card is lost, stolen, or damaged, act quickly to protect your account. For lost or stolen cards, immediately call the Lost/Stolen Department at 1-800-314-6340 (available 24/7). Your account will be secured with fraud monitoring, and you won’t be responsible for unauthorized charges.

For damaged cards or routine replacements, call customer service at 1-800-305-0330 (6 AM – 6 PM Pacific Time, seven days a week). Your replacement card should arrive within 14 business days, typically at no charge.

Contact Information for Milestone Card

Having the right contact information ensures you can always reach customer service when needed:

Phone Numbers:

- Main customer service: 1-800-305-0330

- Alternative customer service: 1-800-224-4960

- Lost/Stolen cards: 1-800-314-6340 (24/7)

Mailing Addresses:

- General correspondence: Concora Credit, PO Box 4477, Beaverton, OR 97076-4477

- Payment address: Concora Credit, PO Box 96541, Charlotte, NC 28296-0541

Online Access: Manage your account at www.mymilestonecard.com, where you’ll find account management tools, payment options, and secure messaging with customer service. The website also provides helpful resources about credit building and responsible card use to support your financial journey.