How to apply for the Chase Freedom Flex Mastercard Credit Card

When it comes to choosing a credit card that aligns with your financial needs, Apply for Chase Freedom Flex stands out as a notable choice. Not only does this Mastercard combine impressive benefits, it also offers flexibility that few cards can rival. If you want to optimize your rewards, this card could be the right choice for you.

Advertising

Nowadays, the search for a credit card that offers exclusive advantages is intense. Finding a card that balances attractive rewards with competitive rates and security is vital. And this is where the Chase Freedom Flex Mastercard comes into play, establishing itself as a tempting option for modern consumers.

Advertising

If you’re ready to take a smart financial leap, read on. Let’s dive into the features of this card, understand its benefits and find out if it’s the perfect fit for your pocket and lifestyle. Get ready for a transformative financial journey!

How do I apply for the Chase Freedom Flex Card?

Want to make your finances even more flexible and enjoy exclusive benefits? Follow these simple steps to order Chase Freedom Flex!

Advertising

- Visit Chase’s official website.

- Locate the “Credit Cards” section.

- Select “Chase Freedom Flex” from the list.

- Click “Apply Now” or “Apply”.

- Fill in the form with your personal data.

- Provide financial information as requested.

- Review and confirm the terms and conditions.

- Click “Submit” or “Finish Enrollment”.

- Wait for the bank’s credit analysis and response.

Ready! After following these steps, you will soon receive a response about the approval of your request.

How to apply for a duplicate of the card?

First, go to Chase’s official website and log in to your account. In the control panel, look for the option related to managing your card. There, you will find the option to request a duplicate. In many cases, the bank will also offer the option to temporarily block the current card.

Also, if you prefer, you can contact Chase’s customer service directly by phone. When communicating with an attendant, inform about the need for a new copy of your Freedom Flex card. They will guide you through the next steps and possibly offer safety tips to avoid future problems.

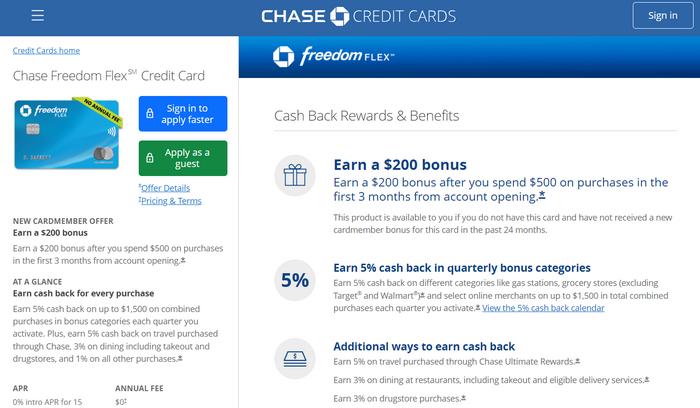

Benefits of the Chase Freedom Flex Card

The Chase Freedom Flex card is known for offering a variety of benefits to its users. Here are some of the key benefits that make this card an attractive option:

- Cashback Rewards : Earn a percentage back on multiple shopping categories, which vary throughout the year.

- Sign-up Bonus : Get a special bonus when you spend a certain amount in the first few months after opening the account.

- 0% Initial Interest : Enjoy an introductory 0% interest rate on purchases and balance transfers during the first few months.

- No annual fee : Enjoy all the benefits of the card without worrying about an annual fee.

- Fraud Protection : Features advanced security technology and 24/7 protection against unauthorized transactions.

- Partnerships and Discounts : Access to exclusive offers and discounts at partner establishments.

- Payment Flexibility : Flexible balance payment options, facilitating financial management.

- Travel Insurance : Coverage for unexpected situations during your trips, including trip cancellation and delay.

- Extended Warranty : Extend the original manufacturer’s warranty on eligible products purchased with the card.

With all of these benefits, the Chase Freedom Flex Card has established itself as an excellent choice for those looking to maximize their rewards and enjoy a premium credit experience.

Card Phone

Want to clarify doubts or obtain additional information about Chase Freedom Flex? Don’t worry, we have the phone numbers you need:

- Access from the outside : +1 302 594 8200.;

- Customer Service – Chase : 1-800-935-9935.

So, if you still don’t have yours, go to the Chase website now and request your Chase Freedom Flex card. In a short time, it will be delivered directly to your address. And be sure to stay with us for the best credit card information.