How to Apply for the Citi Diamond Preferred Credit Card

The process of choosing the right credit card can be challenging, especially with so many options available on the market. But if you’re thinking about apply for Citi Diamond Preferred, you’re about to experience one of the most prestigious Mastercard cards available. Renowned for its versatility and exclusive benefits, this is a choice that deserves your attention.

Advertising

For years, Citi has set high standards when it comes to banking and financial services. The Citi Diamond Preferred is no exception. Its special features and personalized offers make it an interesting option for those looking for more than just a payment method.

Advertising

Dive into this universe with us and discover what makes the Citi Diamond Preferred a standout card. If you are looking for quality, reliability and exclusive advantages, you have come to the right place. Find out more about this card and make the right decision for your budget and your lifestyle.

How do I apply for the Citi Diamond Preferred Card?

Purchasing the Citi Diamond Preferred card is a journey that combines simplicity with security. Understand, below, the procedure to obtain this coveted card:

Advertising

- Visit the official Citi website. From the home page, search for the option for the Citi Diamond Preferred Mastercard.

- Once you select your Citi Diamond Preferred option, you will be redirected to a details page. Here, you can check out all the benefits and advantages that this card has to offer.

- In the corner of the screen, click on the “Request Now” button or similar. This will be the beginning of your application process.

- On the next screen, enter the requested information, such as CPF, full name, email address and telephone number.

- Proceed with filling out, providing additional data that may include your monthly income, employment and other relevant information.

- After filling out, review all the information entered to ensure everything is correct.

- Click to submit your request to Citi. Your order will now undergo a credit analysis.

Wait for a response from the bank, which generally contacts you via email or telephone to inform you of the approval. Remember: like any credit card, accuracy in the information provided is crucial to analysis. Once approved, you can download the Citi app to manage and monitor all activities related to your card.

How do I request a second copy of the card?

Losing or damaging a credit card can be a stressful situation, but banks understand this eventuality and generally make the process of requesting a duplicate as simple as possible. If you find yourself in this situation with the Citi Diamond Preferred or any other card, don’t worry.

First, it is essential to report the loss, theft or damage to your card to the financial institution as quickly as possible. This quick action minimizes risks associated with misuse of the card by third parties. In most cases, you can do this via a customer service phone number or through the bank’s mobile app.

After notifying the institution about the status of the card, they normally begin the procedure for sending a new copy. They will verify your details, confirm your identity and then process your request. Some institutions may charge a fee for issuing a duplicate, so it is always a good idea to check this information in advance.

Benefits of the Citi Diamond Preferred Card

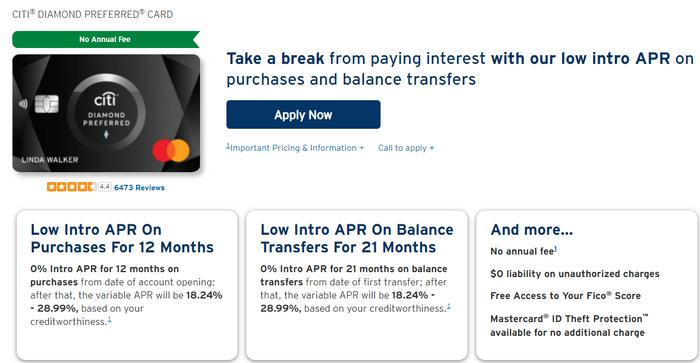

The Citi Diamond Preferred is not just another credit card on the market. It carries the prestige and quality of services associated with the Citi name, offering a series of exclusive advantages to its holders. Let’s check out some of the most notable benefits of this card:

- Competitive Interest Rate: With one of the most attractive rates, it is ideal for those looking to save on financial charges.

- Extended Grace Period: The card offers a generous interest-free period for new purchases, making it easier to manage larger expenses.

- Rewards Program: Accumulate points with every purchase and redeem them for a variety of rewards, from travel to exclusive products.

- Enhanced Security: Equipped with chip and contactless technology, it provides fast and secure transactions.

- Global Assistance: In case of emergency, holders can count on travel assistance services, whether for medical or legal issues.

- Exclusive Discounts: Access to promotions and discounts at selected partners, covering stores, restaurants and various services.

- Online Management: Through the Citi app or website, you can track expenses, pay invoices and manage your card easily and securely.

- Personalized Service: Citi Diamond Preferred holders receive dedicated customer service, ready to resolve any card-related issues.

With so many perks, it’s clear why the Citi Diamond Preferred is considered a premium choice in the credit card world. It combines flexibility, security and exclusive benefits, making it a valuable financial tool for its holder.

Citi Diamond Preferred Credit Card Phone Number

Citibank recognizes the importance of media to connect with its customers. The institution offers a variety of communication channels so that customers can contact the company and obtain support.

For Citi Diamond Preferred Card Mastercard customers, the available telephone numbers are as follows:

- For general support: 1-800-950-5114

- For lost or stolen card: 1-800-695-5114

- For account support: 1-800-695-5114

By offering a variety of phones, Citibank seeks to make it easier for customers to access its services and products. The institution understands that customers have different preferences and needs, and that they need options to communicate with the company in a convenient way.