How to apply for The Platinum Card

In modern times, the way we handle money and transactions has evolved remarkably. When you apply for The Platinum Card, you are not just purchasing a credit card, but also a symbol of prestige and a wide range of exclusive benefits. This card represents more than status; is a passport to premium experiences in the world of finance.

Advertising

Thinking about convenience and benefits, The Platinum Card stands out not only for its sophisticated design, but also for the advantages it offers. From accessing VIP lounges at airports to special offers at top hotels, owning this card is tantamount to joining a select club.

Advertising

Curious to learn more about how it can transform your financial and travel experience? In this article, we’ll dive deep into the world of The Platinum Card and show why many consider it the ultimate card for those seeking exclusivity and unrivaled benefits. Get ready for a journey of luxury and convenience.

How to apply for The Platinum Card

In this brief overview, we’ve provided a simplified step-by-step guide so you know exactly what to do to order your The Platinum Card. Let’s go to the process!

Advertising

- Go to the official website of the bank or financial institution issuing The Platinum Card.

- Locate the “Cards” or “Request Card” option.

- Select “The Platinum Card” from the list of available cards.

- Fill in the request form with your personal, financial and contact details.

- Submit requested documents such as proof of income and identity.

- Wait for the credit analysis.

- If approved, wait for the card to be received at your address.

- Once received, activate the card by following the instructions provided.

- Set a secure password for transactions.

- Ready! Now you can start using The Platinum Card and enjoy all the exclusive benefits.

How to apply for a duplicate of the card?

The loss or damage of a card is a mishap that can happen to anyone. Fortunately, requesting a duplicate of your card is a simple process. Initially, it is essential to notify the bank or financial institution about the loss, theft or damage, thus ensuring your financial security.

Normally, this communication can be made through the institution’s application, official website or by phone, accessing the customer service center. Upon notification, the institution normally blocks the previous card to prevent misuse.

Finally, when requesting the duplicate, a fee may be charged, depending on the bank’s policy. However, in many cases, this issuance may be free of charge. After the request, just wait for the new card to arrive at your registered address and, as soon as you receive it, activate it following the instructions provided.

Annuity and fees

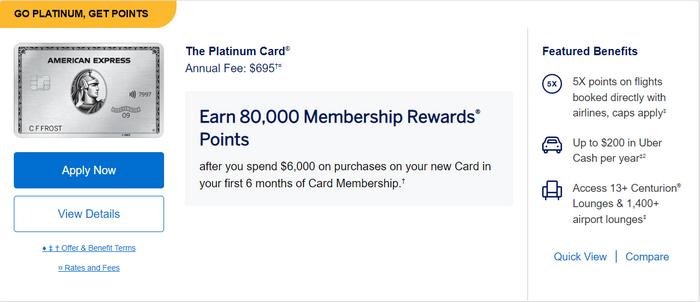

The annual fees and annual fee for the Amex Platinum card vary depending on the market in which it is offered and the American Express policy in each region. Generally, the Amex Platinum is considered a premium card, with an annual fee that reflects the exclusive benefits it offers.

In Brazil, for example, the annual fee is usually around $1,400 to $1,600 per year, which can be paid in up to 12 installments. In the United States, the current annual fee is approximately US$ 695, subject to variations.

In addition, some additional fees may apply:

- Revolving interest: If you don’t pay your bill in full, the interest rate will be applied to the remaining balance.

- Withdrawal fee: Applied when the card is used for cash withdrawals (usually a percentage of the amount withdrawn, plus a fixed fee).

- Currency conversion: International purchases may include a currency conversion fee.

It’s worth checking directly with American Express or on the card agreement for up-to-date and detailed rates. If you are already a customer, please contact the Customer Service Center with any questions about specific fees.

How to access a duplicate bill for this card

To access the 2nd copy of your Amex Platinum card bill, follow the steps below:

1. Via the American Express App

Download the official American Express app (available on the App Store and Google Play).

Log in with your registered username and password.

Access the Invoices or Statements option and select the desired month.

Download or copy the barcode to make the payment.

2. Via the Official Website

Go to the American Express website.

Log in to your account with your login and password.

In the main menu, click on Invoices or Manage Account.

Choose the month of the invoice and print or use the barcode to pay.

3. Call Center

Call the American Express Call Center at the number on the back of your card.

Ask for the 2nd copy of your bill to be sent to you by e-mail or SMS.

4. ATMs and Internet Banking

If you are a customer of a partner bank, access your Internet Banking or ATM and find the invoice under Credit Cards.

These options guarantee quick and easy access to your invoice.

Benefits of the The Platinum Card

The cardholder enjoys a series of benefits, making each experience even more premium. Discover some of the benefits of this prestigious card:

- Access to VIP lounges at international airports.

- Exclusive deals on luxury hotels and resorts.

- Premium points program with advantageous exchanges.

- Concierge service available 24 hours.

- Shopping protection and travel insurance.

- Personalized customer service.

- Exclusive benefits at partner restaurants.

- Exemption or discounts on service fees.

- Exclusive promotions and events for cardholders.

- Travel assistance and emergency services abroad.

With so many benefits on offer, it’s no wonder that The Platinum Card is coveted by those looking for an upscale, luxurious financial experience.

Why should I apply for a platinum card?

The Amex Platinum card is more than just a means of payment: it represents access to an experience of exclusivity and sophistication that few cards on the market can offer. By applying for this card, you are investing in benefits that transform the way you travel, consume and enjoy the best the world has to offer.

For those who value comfort and practicality, access to more than 1,400 VIP lounges in the main global airports redefines the travel experience, guaranteeing peace of mind and convenience. In addition, Amex Platinum offers comprehensive travel insurance, which provides security and protection anywhere in the world.

Another highlight is the Membership Rewards program, which converts your spending into points that never expire. These points can be exchanged for a wide range of rewards, including airline tickets, luxury stays and premium products.

The card also offers exclusive advantages for purchases, such as protection against damage or theft and extended warranties.

Whether you want to explore the world in greater comfort, accumulate valuable rewards or count on personalized 24/7 service, Amex Platinum is the ideal choice for those seeking a refined lifestyle full of possibilities.

Telephone

Find out how to contact The Platinum Card information via phone numbers:

- Customer Service: 1-800-528-4800;

So head over to the official website now and order your The Platinum Card. In a few days, it will be delivered to the comfort of your home. And don’t forget to stay with us for the latest credit card information.