Benefits of the Bank of Americard Card: Find out everything to apply

Navigating the vast world of credit cards can be overwhelming, but the Bank of Americard stands out as a beacon for many savvy consumers. This card not only partners two trusted financial giants but also boasts an array of advantages tailored for diverse spending habits. Whether you’re a frequent traveler, a dedicated shopper, or someone seeking financial flexibility, there’s something in it for everyone.

Advertising

From unparalleled rewards programs to cutting-edge security features, the benefits are vast and varied. You might be asking, what makes this card so special compared to its counterparts? Well, it’s more than just a plastic card; it’s a passport to a world of opportunities and conveniences.

Advertising

As we delve deeper into the unique offerings of the Bank of Americard, you’ll discover how it could potentially reshape your financial journey. So, fasten your seatbelt and get ready to uncover the myriad of perks that await behind that glossy card surface. Let’s dive in!

Bank of Americard Benefits

When it comes to maximizing your financial flexibility and garnering a slew of attractive perks, the Bank of Americard is hard to beat. Here’s a direct rundown of its standout benefits:

Advertising

- Competitive Rewards Program: Earn points on every purchase which can be redeemed for cash back, travel rewards, or gift cards.

- No Foreign Transaction Fees: Perfect for international travelers.

- Introductory 0% APR: An attractive rate for new cardholders.

- Extended Warranty Protection: Extra peace of mind on your purchases.

- Free FICO Score Access: Stay updated on your credit health.

- Contactless Payment Technology: Tap and pay with ease and security.

- Exclusive Cashback Deals: With BankAmeriDeals for added savings.

- Global Service Assistance: Round-the-clock help, wherever you are.

Whether you’re dining out, fueling up, or traveling the globe, the Bank of America Mastercard ensures you’re equipped with the best in the business. Grab yours and experience the difference!

Does the Bank of America card accept negatives?

Bank of America, like most significant banking institutions, prioritizes the creditworthiness of its applicants. This means that individuals with a pristine credit history often have an easier time getting approved. However, having a negative mark on your credit report doesn’t automatically disqualify you. The bank assesses various factors, including your overall financial health, recent credit behaviors, and current debts.

Card flag

The Bank of Americard Mastercard carries an international flag. This means cardholders can enjoy its benefits not just within the boundaries of their home country but globally. Wherever you see the Mastercard logo, whether it’s a local store or a foreign destination, your card is poised to serve you.

What is the annual fee for the Bank of America card?

Bank of America is known for its consumer-friendly features, and one of its notable attributes is its competitive fee structure, which is why its annual fee is $0

Bank of America card app

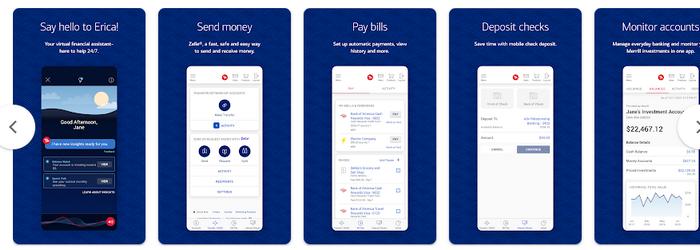

In an age where our smartphones have become an extension of ourselves, the Bank of Americard app stands as a testament to the evolving demands of modern banking. The app seamlessly integrates the vast financial functionalities of Bank of America with the convenience and accessibility of a digital platform.

The importance of such an application in today’s world cannot be overstated. Not only does it cater to the immediate need for on-the-go banking solutions, but it also embodies a holistic approach to managing one’s finances. From monitoring account balances to ensuring timely bill payments and even seeking customer support, the Bank of Americard app has transformed how cardholders interact with their financial portfolios.

Moreover, with digital security threats becoming increasingly sophisticated, having a dedicated platform ensures that users benefit from the latest in encryption and security protocols. This balance of convenience and safety positions the Bank of Americard app as not just an accessory to the credit card, but a pivotal tool for holistic financial management in the digital age. Embracing it means embracing an era where control, clarity, and comfort in banking are just a tap away.

Phone

Bank of America understands the vitality of clear, direct, and efficient communication in the realm of banking. In an industry where trust and clarity are paramount, maintaining robust channels of communication is not just a necessity but a commitment to their clientele. By providing various phone lines tailored to specific needs, Bank of America ensures that each customer finds a direct route to the assistance they seek.

Here are some of the contact numbers available for different services:

- General Customer Service: 1-800-432-1000;

- Credit Card Support: 1-800-732-9194;

- Mortgage and Loans: 1-800-626-6265;

- Investment Services: 1-800-433-3321;

- Fraud Protection: 1-800-872-1111;

- International Helpline: 1-980-332-6000.

This emphasis on phone communication demonstrates the bank’s dedication to being accessible. Whether you’re facing a pressing issue, seeking guidance, or simply need clarity on a service, Bank of America’s phone lines stand as a testament to their unwavering commitment to serve.