Benefits of the Bank of America Premium Reward Elite Card: Find out everything to apply

The Bank of America Premium Reward Elite Card is the ideal premium credit card for those looking for more than just rewards. With it, you can enjoy a series of exclusive benefits, such as access to airport VIP lounges, travel insurance and purchase insurance.

Advertising

Imagine having access to incredible rewards every time you make a purchase. With this card, every transaction is an opportunity to earn points that can be redeemed in a variety of ways. Whether for travel, shopping or exclusive services, this card makes every spend more rewarding. Want to learn more about how the Bank of America Premium Reward Elite Card can help you make the most of life? Keep reading to discover all its benefits!

Benefits of the Bank of America Premium Reward Elite Card

Advertising

The Bank of America Premium Reward Elite is a credit card that offers a series of exclusive benefits to its users. Here are some of the key benefits you can expect when you become a cardholder:

- Welcome Bonus: You can earn 75,000 bonus points, equivalent to a $750 credit, after spending at least $5,000 on purchases in the first 90 days after account opening.

- Automatic statement credits: Receive up to $550 in automatic statement credits, including up to $300 annually in airline incidental credits for eligible purchases such as seat upgrades, baggage fees, airline lounge fees and in-flight services.

- Unlimited Points with Flexible Rewards: Earn unlimited 2 points for every dollar spent on travel and restaurant purchases, and 1.5 points per dollar on all other purchases. There is no limit to the points you can earn and points do not expire.

- Priority Pass Select Access: Enjoy free unlimited access to lounges and airport experiences around the world with up to 4 free Priority Pass™ Select memberships.

- Car rental protections, insurance and benefits: The card offers a range of car rental protections, insurance and benefits.Global Entry Credit: Receive up to $100 in statement credits for Global Entry or TSA PreCheck® application fees every four years .

With Bank of America Premium Reward Elite, every purchase becomes an opportunity to earn rewards and enjoy the exclusive benefits this card has to offer.

Advertising

Does the Bank of America Premium Reward Elite Card accept negatives?

No, the Bank of America Premium Reward Elite Card does not accept negatives. This card is aimed at customers with a good credit history, as it offers exclusive benefits, such as access to airport VIP lounges, travel insurance and purchase insurance.

To apply for the Bank of America Premium Reward Elite Card, you must have a minimum credit score of 720. A credit score is a score that evaluates a person’s credit history, including timely payments, loans and financing .

Card Flag

The Bank of America Premium Reward Elite Card is issued by Visa. Visa is an international brand, which means the card can be used for purchases around the world.

What is the annual fee for the Bank of America Premium Reward Elite Card?

The annual fee for the Bank of America Premium Reward Elite Card is US$550. This amount is charged annually, regardless of the number of purchases made with the card.

The card offers some benefits that can help offset the annual fee, such as:

- Access to VIP lounges at airports through Priority Pass Select.

- Travel insurance, with coverage for medical expenses, flight cancellations and lost luggage.

- Purchase insurance, with coverage for theft and damage.

Bank of America Premium Reward Elite Card App

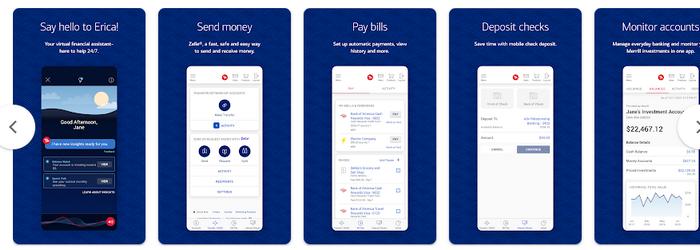

The Bank of America Premium Reward Elite Card app is a powerful tool that allows customers to manage their credit cards quickly and easily. There, you can view the current balance and available limit of your credit cards, as well as a history of all purchases made with your credit cards. They can also receive notifications of new transactions on their credit cards and request statements from their credit card accounts in PDF or CSV format.

The Bank of America Premium Reward Elite Card app is easy to use and offers an intuitive interface. Customers can access all important information about their credit cards with just a few taps. The app is available for Android and iOS devices and offers a variety of features.

Phone Number

Bank of America recognizes the importance of communications media to connect with its customers. The institution offers a variety of communication channels so that customers can contact the company and obtain support.

For Bank of America Premium Reward Elite Card customers, the available means of communication are as follows:

- Credit card customer service: 800.732.9194;

- Credit card activation: 800.276.9939;

- Credit card billing inquiries: 866.266.0212;

- Online chat: Available on the Bank of America website;

- Social networks: Bank of America is present on the social networks Facebook, Twitter, LinkedIn and YouTube.

By offering a variety of means of communication, Bank of America seeks to make it easier for customers to access its services and products. The institution understands that customers have different preferences and needs, and that they need options to communicate with the company in a convenient way.