Chase Sapphire Preferred Card Benefits: Learn Everything to Apply

The Chase Sapphire Preferred Card is not just another credit card on the market. It represents a universe of benefits, rewards and facilities that transcend the traditional. With a sleek design and impressive features, it’s no wonder many consider it the card of choice for travelers and rewards enthusiasts alike.

Advertising

If you haven’t had the chance to experience what this card offers yet, get ready for a journey through its exclusive advantages. From boosted points in certain shopping categories to special travel protections, every detail has been designed to maximize cardholder satisfaction.

Advertising

Understanding the Chase Sapphire Preferred Card is discovering a new way to interact with your finances and redefining what you expect from a premium card. I invite you to dive into this universe and explore everything it has to offer. Your financial potential deserves this opportunity.

Chase Sapphire Preferred Credit Card Benefits

The Chase Sapphire Preferred Card has earned a place among the best premium credit cards. Its benefits package goes beyond what many other cards offer, making every transaction a more rewarding experience. Let’s explore some of the key benefits and perks that make it so desirable.

Advertising

- Boost Points : One of the great attractions of Chase Sapphire Preferred is its ability to offer more points in popular categories. For example, on travel and dining, cardholders earn 2 points for every dollar spent. Plus, when you use points through the Chase Ultimate Rewards portal, they can be worth 25% more, ensuring even more value.

- Travel Protection : Traveling with the Chase Sapphire Preferred Card is peace of mind. It offers everything from cancellation and trip interruption protection to comprehensive rental car insurance. So travelers can focus on what really matters: enjoying their adventures.

- No Overseas Transaction Fees : For international travel lovers, the absence of overseas transaction fees is an advantage that cannot be ignored. With Chase Sapphire Preferred, there are no surprises when shopping abroad.

- Flexible points transfer : The freedom to transfer points to various partner loyalty programs, often on a 1:1 ratio, is a differentiator. This allows cardholders to optimize their rewards and choose the best way to spend them.

- Purchase protection and extended warranty : Purchases made with the card are safer, thanks to protection against damage and theft. In addition, many products purchased with Chase Sapphire Preferred come with an extended warranty, bringing more peace of mind to the consumer.

This is just a glimpse of what the Chase Sapphire Preferred Card has to offer. The combination of high value benefits, flexibility and protections makes it a top choice for those looking to excel in their credit cards.

Chase Sapphire Preferred Card accept negatives?

If you have a “negative” name, that is, you have records with credit protection agencies, the probability of approval for Chase Sapphire Preferred is significantly lower. Chase, like many other banks, considers credit score, financial history and other factors related to an applicant’s financial health before approving a credit card application.

For Chase Sapphire Preferred, it is desirable that applicants have a good credit score and a solid financial history. People with negative records or outstanding debts may face difficulties in the approval process.

Flag

The Chase Sapphire Preferred Card is issued under the Visa flag. Being more specific, it falls under the Visa Signature category. This means that in addition to the standard Visa benefits, Chase Sapphire Preferred holders have access to exclusive additional benefits offered by the Visa Signature program. Due to its Visa flag, the card is widely accepted at millions of establishments around the world, making it an excellent choice for international travel and shopping in a variety of locations.

The Chase Sapphire Preferred annual fee is $95.

The interest rate on Chase Sapphire Preferred fluctuates based on the US base rate plus an additional percentage set by Chase.

Application

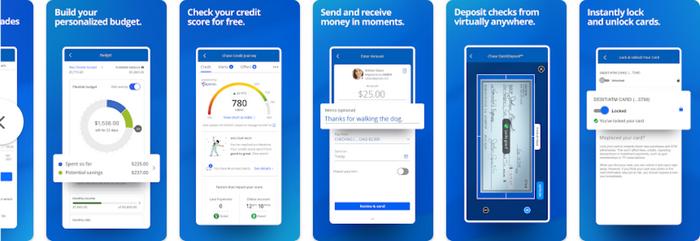

The digital age brought with it the convenience of managing our finances in the palm of our hands. The Chase Sapphire Preferred Card, being one of the most popular premium cards on the market, is not far behind when it comes to offering an optimized digital experience for its users. Here we will discuss the features and benefits of the app associated with this card.

- Fast and Secure Access : The app allows cardholders to securely access their accounts with fingerprint, face recognition or password authentication. This ensures your information remains protected while providing quick and convenient access;

- Rewards Management : One of the most notable features is the ability to manage and redeem your rewards. Users can view their points balance, check transaction histories and even redeem points for trips, products or other services directly through the app;

- Alerts & Notifications : Stay up-to-date with real-time notifications on transactions, monthly statements, and other important alerts. This functionality not only provides convenience, but also an additional layer of security against suspicious activity;

- Expense Management : The application offers tools to monitor expenses, categorize transactions and even establish budgets. This helps cardholders keep their finances in check and make more informed financial decisions;

- Customer Service : In case of questions or problems, the application provides a direct channel to contact customer service, either through live chat, email or telephone.

To perform the download:

Telephone

Having quick and direct access to your credit card support is essential for solving questions, solving problems or dealing with any other matter related to your account. Chase Sapphire Preferred, renowned for its excellent customer service, offers multiple avenues of communication. The main one is:

- Customer Service Hotline :1-800-432-3117

Regardless of the method chosen, Chase strives to provide high quality customer service, ensuring that the needs and concerns of Chase Sapphire Preferred holders are addressed effectively and efficiently.