Benefits of the Citi American Airlines Card: Find out everything to apply

The Citi American Airlines card has been a popular choice among travelers and aviation enthusiasts. Integrating Citi’s facilities with American Airlines’ advantages, this card combines the best of both worlds, guaranteeing exclusive benefits to its users. Do you want to understand how it can be your ideal companion on your next trips?

Advertising

Currently, the financial world offers a huge variety of credit card options, each with its own particularities. However, when looking for a tool that combines financial management with privileges in the airline sector, few stand out as much as the Citi American Airlines card.

Advertising

If you have a passion for traveling and are looking for a card that rewards you for it, you’ve come to the right place. Embark with us on this informative journey and discover the benefits, advantages and reasons why Citi American Airlines deserves a space in your wallet.

Benefits of the Citi American Airlines Card

The Citi American Airlines Card is more than just a payment method. It stands out for its multiple benefits designed for those who love traveling and want more rewarding experiences. Check out the main benefits you can enjoy when opting for this card:

Advertising

- Bonus Air Miles: With every purchase made with the card, accumulate miles that can be exchanged for airline tickets and class upgrades.

- Access to VIP Lounges: Travel in comfort with access to VIP lounges at selected airports around the world.

- Priority Check-in: Avoid long lines and enjoy the privilege of fast, exclusive check-in on American Airlines flights.

- Extra Baggage Allowance: When you fly with American Airlines, enjoy an additional baggage allowance at no extra cost.

- Partner Discounts: Get exclusive discounts at hotels, restaurants and services that partner with the American Airlines loyalty program.

- Free Travel Insurance: Travel with peace of mind knowing that you are protected with travel insurance at no additional cost.

- Special Installments: Take advantage of special installment conditions on airline tickets and services related to American Airlines.

- Premium Service: Get access to an exclusive and personalized customer service, ready to meet all your needs.

- Favorable Miles Conversion: Convert your purchases into miles at a more advantageous rate, accelerating your benefits.

- Exclusive Promotions: Always be in the loop for promotions and special offers available only to Citi American Airlines Cardholders.

Having the Citi American Airlines Card means embracing a life of conveniences, benefits and unique experiences. It is the perfect ally for those who want more than just flying, but rather flying with style and benefits.

Does the Citi American Airlines card accept negative payments?

The Citi American Airlines card does not accept negative payments. To apply for the card, the customer must have a good credit score, which is an assessment of their ability to pay. The score is calculated based on a series of factors, including payment history, debts and income.

However, there are some exceptions. Citi American Airlines may accept denials in some cases, such as:

- If the customer has a low credit score but has a good payment history.

- If the client has a high income.

- If the customer has a security deposit.

Card Flag

The card is issued by Mastercard, which is an international brand. However, for this card, two types of coverage are offered: national and international. National coverage includes protection against theft, damage, loss and delay of baggage. International coverage includes protection against medical expenses, flight cancellations and delayed baggage.

What is the annual fee for the Citi American Airlines Card?

The annual fee for the Citi American Airlines Card is $95. However, cardholders can receive an annual fee waiver if they spend at least $2,500 on eligible purchases in the first year.

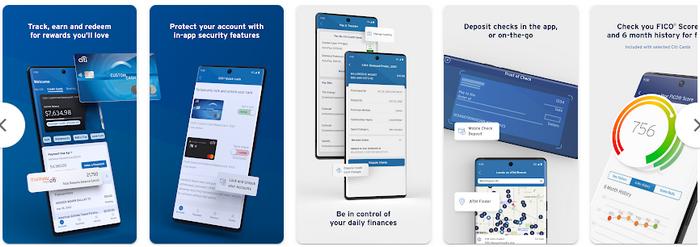

Citi American Airlines Card App

The application was designed with an intuitive and friendly interface, allowing users to easily navigate between the various features. Whether you want to check your balance, check your statement, track mileage accumulation or even access exclusive offers, the app becomes an indispensable tool. By facilitating access to this information, it helps make financial planning and expense management more transparent and efficient tasks.

In addition to practicality, security is another fundamental pillar of the application. All transactions and queries are protected by advanced security protocols, ensuring that your data remains confidential and that any movement on the card is carried out with complete reliability.

In times of agility and immediacy, having an application like the Citi American Airlines Card is more than a luxury: it is a necessity. It transforms the user experience, making it more dynamic, modern and, above all, convenient. Therefore, for cardholders, the app is another ally in the journey of making the most of the benefits and facilities that the modern financial world can offer.

Telephone

The telephone is a classic and fundamental communication tool, especially when it comes to financial services. Through it, the holder can resolve doubts, report problems, request services and even receive personalized guidance. Therefore, Citi is dedicated to ensuring that this channel is always efficient, providing agile, high-quality service, regardless of demand.

To contact the specialized Citi American Airlines Card team, cardholders can use the following numbers:

- Telephone: 1-800-950-5114;

- Online chat: Available on the Citibank website;

- Social networks: Citibank is present on the social networks Facebook, Twitter, LinkedIn and YouTube.

This dedication to maintaining high-quality communication channels reiterates the institution’s commitment to meeting the needs of its customers, ensuring that, regardless of the situation, they can count on the necessary support in a practical and efficient way.