Benefits of the Citi Diamond Preferred Card Mastercard: Find out everything to apply

In a world where the use of credit cards has become essential, choosing the right option is essential for efficient financial management. Among so many alternatives available, the Citi Diamond Preferred Card Mastercard stands out as one of the most interesting options. Offering a combination of unique benefits and features, it stands out in the current financial landscape.

Advertising

Have you ever wondered which card could offer you not only easy payments, but also exclusive advantages? The Citi Diamond Preferred Card is not just a payment instrument; is a lifestyle tool, designed for those looking for more than just a simple transaction. Its advantages range from competitive interest rates to exclusive benefits for its users.

Advertising

We invite you to dive into the universe of the Citi Diamond Preferred Card Mastercard. Discover how it can be your ideal partner when traveling, shopping and in everyday financial planning. Join us on this journey and discover why this card is so recommended and desired by many consumers around the world.

Benefits of the Citi Diamond Preferred Card Mastercard

The Citi Diamond Preferred Card Mastercard is not just a conventional credit card. It is designed to provide a superior experience to its users. Let’s explore some of the key benefits that make this card a top choice for many:

Advertising

- Competitive Interest Rates : One of the great advantages of this card is that it offers attractive interest rates. For those who usually pay in installments or need a longer period to pay off the bill, this benefit can represent significant savings.

- Rewards Program : With the Citi Diamond Preferred Card, every purchase becomes an opportunity to earn points. These points can be redeemed for a variety of prizes, from airline tickets to exclusive products and services.

- Payment Flexibility : This card offers different options for due dates and payment methods, allowing the user to choose the one that best suits their cash flow.

- Advanced Security : In today’s scenario where card fraud is a constant concern, the Citi Diamond Preferred Card comes with advanced security features. Integrated chip technology and real-time alerts system ensure your transactions are protected.

- Excellent Customer Service : The Citi support team is always ready to help. Whether to resolve a question about the invoice, request a duplicate or even for assistance in emergency situations, service is fast and efficient.

- Travel Benefits : For those who love traveling, this card offers a series of facilities. From travel insurance to airport lounge access, Citi Diamond Preferred makes every journey more comfortable and hassle-free.

When considering all of these advantages, it becomes clear why the Citi Diamond Preferred Card Mastercard is such a popular choice among consumers. It not only facilitates everyday financial transactions but also enriches the user experience with exclusive rewards and benefits.

Does the Citi Diamond Preferred Card Mastercard accept negatives?

The Citi Diamond Preferred Card Mastercard, being a product from one of the main financial institutions, adopts strict criteria in its credit analyses. They do not accept applicants who are negative, prioritizing individuals with more solid and reliable financial histories.

Card Flag

The Citi Diamond Preferred Card, as its name suggests, operates under the Mastercard brand, one of the largest and most recognized payment networks in the world. This brings a series of advantages to the cardholder, given Mastercard’s wide acceptance in millions of merchants globally.

As for the coverage of the Citi Diamond Preferred Card Mastercard, it is an international card. This means that it can be used both in transactions within Brazil and in purchases and withdrawals abroad. The ability to carry out international transactions is particularly useful for travelers or those shopping on foreign websites.

What is the annual fee for the Citi Diamond Preferred Card Mastercard ?

The annual fee for the Citi Diamond Preferred Card Mastercard is US$95.00. However, there is an annual fee exemption for those who spend at least US$6,000.00 on purchases on the card during the first year.

Citi Diamond Preferred Card Mastercard Application

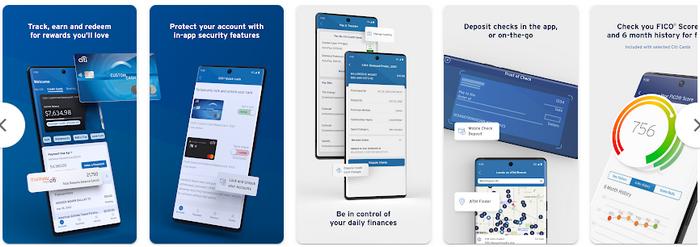

In the digital age, having access to credit card features in the palm of your hand has become a necessity. The Citi Diamond Preferred Card Mastercard application was developed to meet this demand, providing a fluid and intuitive experience for its users.

With a user-friendly and secure interface, the application allows cardholders to manage their transactions, check balances, access invoices and even make payments with just a few taps. One of the great advantages is the ability to receive notifications in real time, which increases transaction security and allows users to always be up to date with their financial movements.

In addition to the standard features related to card management, the application also stands out for offering tips and insights about spending, helping consumers to have better financial management. Integration with other exclusive Citi services and promotions also enriches the experience, making the app an indispensable tool for anyone looking to maximize the benefits of the Citi Diamond Preferred Card Mastercard.

Telephone

Citibank recognizes the importance of media to connect with its customers. The institution offers a variety of communication channels so that customers can contact the company and obtain support.

For Citi Diamond Preferred Card Mastercard customers, the available means of communication are as follows:

- Telephone: 1-800-950-5114;

- Online chat: Available on the Citibank website;

- Social networks: Citibank is present on the social networks Facebook, Twitter, LinkedIn and YouTube.