Capital One Spark Cash Plus: How to request, Main benefits and other services

With a strong presence in the market, Capital One offers a wide range of credit cards, checking accounts, loans, and investment services. The bank is known for its innovation and customer focus, providing financial solutions that meet the needs of various market segments.

Advertising

One of Capital One’s most popular products is the Spark Cash Plus credit card, which is specifically geared towards small businesses and entrepreneurs. In this article, we will explore how to apply for the Spark Cash Plus card, the steps involved in the process, the associated fees, and the main benefits it offers.

How to Apply for the Capital One Spark Cash Plus Credit Card

Advertising

Applying for a credit card may seem like a complicated process, but Capital One has made it simple for its customers. The Spark Cash Plus is designed to offer a premium credit experience with exclusive perks, such as a 2% rewards rate on all purchases and a significant cash bonus for large spends. If you are looking for a card that combines robust benefits with excellent customer service, the Spark Cash Plus is an excellent choice.

To begin the application process, it is important to be aware of the basic requirements, such as the need to have a good credit score and provide detailed information about your income and financial history. Below, we have provided a detailed step-by-step guide to help you apply for your Capital One Spark Cash Plus credit card in a simple and efficient manner.

Advertising

Step-by-step guide on how to apply for the Capital One Spark Cash Plus card

Access the Capital One website:

- The first step is to visit the Capital One official website (www.capitalone.com) and navigate to the credit cards section.

- Select the Spark Cash Plus card: On the credit cards page, you will find a list of options. Select the Spark Cash Plus card to view the card details and benefits.

- Start the online application: Click on the button to apply online. This will take you to a form where you will need to provide personal information, such as your name, address, social security number, and employment and income information.

- Review and submit your application: After filling out all the required fields, review your information to ensure it is correct. Then, submit your application. You will receive a confirmation that your application has been received.

Wait for approval: Capital One will review your application and check your credit history. This process may take a few business days. You will be notified via email or mail about the status of your application.

What is the Capital One Spark Cash Plus card?

The Capital One Spark Cash Plus credit card is issued under the Visa brand, one of the largest and most recognized payment networks in the world. This means that the card is widely accepted at millions of merchants around the world, providing convenience and flexibility for making purchases, whether online or in-store.

With the Visa brand, Spark Cash Plus cardholders also have access to additional benefits, such as fraud protection, travel insurance and global assistance.

Main Benefits

The Capital One Spark Cash Plus offers 2% cash back on all purchases, with no spending limit or category restrictions. This feature is ideal for companies that have a variety of expenses and want to guarantee a return on all transactions. Plus, there’s a welcome bonus: you can earn up to $2,000 when you spend $30,000 in the first three months. And the benefits don’t stop there. When you spend $500,000 in the first year, you receive an additional $2,000 bonus, helping to further increase your earnings.

Another plus is the absence of international transaction fees, making it perfect for companies with global operations. The card also offers the option of issuing additional cards to employees at no cost, allowing the entire team to contribute to the accumulation of rewards.

In terms of security, the Capital One Spark Cash Plus guarantees protection against fraud, eliminating liability for unauthorized use. The annual fee of $150 can be easily recovered if your company spends at least $150,000 per year, turning this cost into a benefit.

To facilitate financial management, the card allows you to choose the due date for payment, giving you more control over cash flow. And at the end of the year, you receive a detailed report of your expenses, ideal for financial organization and tax filing.

What are the fees for the Capital One Spark Cash Plus card?

Before applying for any credit card, it is crucial to understand the associated fees and charges. The Spark Cash Plus offers a 2% rewards rate on all purchases, with no limits or category restrictions. Additionally, there is a $150 annual maintenance fee.

It’s also important to be aware of foreign transaction fees, late payment fees, and cash withdrawal charges. Referring to the card’s terms and conditions agreement will provide a complete overview of all possible fees and charges.

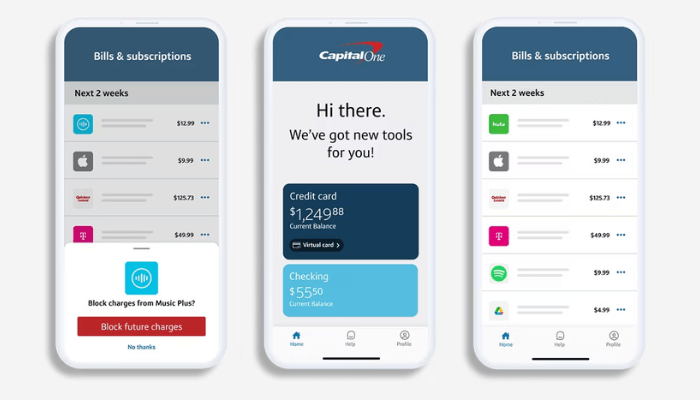

How to Download the Capital One Spark Cash Plus Credit Card App

The Capital One mobile app makes it easy to manage your Spark Cash Plus credit card. To download it, follow these steps:

- Go to the app store: On your smartphone, open the App Store (for iOS) or Google Play Store (for Android).

- Search for “Capital One”: Use the search bar to find the official Capital One app.

- Download and install the app: Click “Download” or “Install” and wait for the installation to complete.

- Sign in: Open the app and sign in using your Capital One account credentials. If you don’t already have an online account, you can sign up directly through the app.

How to Request a Duplicate Capital One Spark Cash Plus Card

To request a duplicate Capital One Spark Cash Plus card, follow these steps:

- Visit the Capital One website: Go to the official Capital One website and log in to your account.

- Find the “My Card” section: Navigate to the section dedicated to your card.

- Request a duplicate: Look for the option to request a duplicate card and follow the instructions provided.

Contact customer service: If you prefer, you can call Capital One customer service and request a duplicate directly. The contact number is usually available on the website or on the back of your card.

Capital One Spark Cash Plus Card Contacts

For support or additional information about the Capital One Spark Cash Plus card, you can use the following contact details:

- Customer Service: Available 24 hours a day, you can call Capital One’s customer service number.

- Official Website: Visit Capital One’s official website and browse through the customer support section.

- Messaging Service: Use the online chat or email provided on the website to send your questions and requests.

The Capital One Spark Cash Plus is an excellent option for businesses looking to earn cash back rewards for their everyday purchases. With a 2% cash back rate on all purchases and a generous welcome offer, this card can help maximize your business’s financial benefits. Plus, Capital One customer service is always available to help with any card-related needs.