Capital One Venture X Rewards Credit Card: A Full Review

Capital One is one of the most innovative and well-known banks in the United States, especially when it comes to credit cards. Over the past two decades, the company has grown its reputation by offering straightforward, user-friendly products with competitive rewards and minimal fees. From beginner-friendly cards to high-end travel cards, Capital One’s offerings span a wide range of customer needs.

Advertising

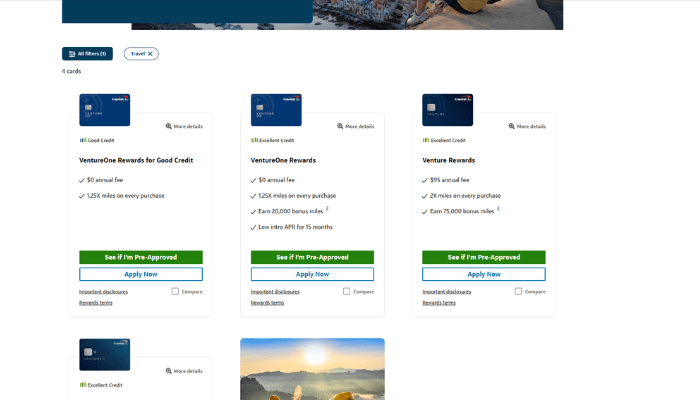

One of its standout premium products is the Capital One Venture X Rewards Credit Card, launched to compete directly with heavy hitters like the Chase Sapphire Reserve® and the Platinum Card® from American Express. The Venture X distinguishes itself with strong travel benefits, an impressive rewards structure, a relatively low annual fee compared to competitors, and a simple, intuitive redemption process.

How to Apply for the Capital One Venture X Card

Advertising

The Venture X is Capital One’s top-tier travel rewards credit card, designed for frequent travelers who want premium benefits without the ultra-premium price tag. While it shares many features with other luxury cards, it comes with a more accessible annual fee and easier-to-use rewards.

It earns unlimited 2X miles on every purchase, plus enhanced earning rates on travel booked through the Capital One Travel portal. Cardholders also enjoy airport lounge access, statement credits, and generous travel protections. Its simplicity and value make it a go-to option for travelers seeking both flexibility and perks.

Advertising

Applying for the Venture X is straightforward and can be done entirely online. Here’s how the process works:

- Check Your Credit Score

Capital One typically requires a good to excellent credit score—around 720 or higher—for approval. A solid credit history and income are essential. - Visit the Capital One Website

Go to www.capitalone.com and navigate to the Venture X product page. Click “Apply Now” to begin your application. - Fill Out the Application

Provide your personal and financial information, including your full name, address, annual income, employment details, and Social Security number. - Submit and Wait for a Decision

Many applicants receive an instant approval decision, although some may be asked for additional information or documentation. - Receive and Activate Your Card

Once approved, you’ll receive your Venture X card within 7–10 business days. You can activate it via the website or Capital One Mobile app.

What Network Does the Venture X Use?

The Capital One Venture X is issued on the Visa Infinite network, which brings along a host of luxury travel and lifestyle perks. Visa Infinite offers premium benefits such as concierge service, travel insurance, purchase protection, and access to luxury hotel programs.

Being on the Visa network also means the Venture X is widely accepted around the world, making it an excellent option for international travelers.

Annual Fee and Other Charges

Despite its premium status, the Venture X card comes with a relatively modest annual fee compared to competitors:

- Annual Fee: $395

- Authorized Users: Up to 4 free authorized users (no extra fee)

- Foreign Transaction Fees: None

- APR: Variable, currently between 19.99% and 29.99%, depending on creditworthiness

- Cash Advance Fee: 3% or $10 minimum

- Late Payment Fee: Up to $40

- Although $395 is a significant annual fee, it is effectively offset by annual benefits such as the $300 travel credit and anniversary bonus miles, making the real cost of ownership surprisingly low.

Rewards and Redemption

The Capital One Venture X offers a simple but powerful rewards structure:

Earning Miles:

- 10X miles on hotels and rental cars booked through Capital One Travel

- 5X miles on flights booked through Capital One Travel

- 2X miles on all other purchases

Miles don’t expire and there is no limit to how many you can earn.

Redeeming Miles:

- Travel purchases: You can use your miles to erase past travel charges (flights, hotels, car rentals) at a value of 1 cent per mile.

- Book travel through Capital One: Miles can be used to book new travel directly.

- Transfer to partners: Transfer miles to over 15 airline and hotel loyalty programs, often at a 1:1 ratio.

- Gift cards and statement credits: Available, though not the most valuable use of miles.

One of the most user-friendly features of Capital One is the ability to “erase” travel purchases with miles after the fact—ideal for spontaneous bookings or deals outside the travel portal.

Key Benefits of the Capital One Venture X Card

Despite its lower price point compared to other premium cards, the Venture X packs a serious punch in terms of value and perks. Here are some of its most attractive benefits:

1. $300 Annual Travel Credit

Each year, cardholders receive $300 in statement credits for travel booked through Capital One Travel. This alone covers most of the card’s annual fee.

2. 10,000 Bonus Miles Each Year

On your account anniversary, you’ll receive 10,000 bonus miles, equal to $100 toward travel. Combined with the travel credit, this offsets the fee entirely.

3. Airport Lounge Access

Cardholders enjoy unlimited access to:

- Capital One Lounges (available at select U.S. airports)

- Priority Pass Select lounges (upon enrollment)

- Authorized users also receive the same lounge access benefits for free.

4. Global Entry or TSA PreCheck Credit

Every four years, cardholders receive up to $100 in statement credit to cover the application fee for Global Entry or TSA PreCheck.

5. Travel and Purchase Protections

Includes:

- Trip cancellation/interruption insurance

- Auto rental collision damage waiver

- Lost luggage reimbursement

- Travel accident insurance

- Extended warranty and purchase protection

These protections offer significant peace of mind for both domestic and international travel.

Capital One Mobile App and Account Management

The Capital One Mobile app is one of the most highly rated in the financial sector. With it, you can:

- View transactions and rewards balance

- Pay your bill and manage payment options

- Set up account alerts and autopay

- Lock and unlock your card

- Redeem miles or transfer to travel partners

The app is intuitive and integrates well with tools like Capital One Shopping, a browser extension that helps users find the best deals online.

How to Replace a Lost or Damaged Venture X Card

If your card is lost, stolen, or damaged, you can request a replacement quickly through these channels:

- Capital One Mobile App: Go to “Settings” > “Replace Card”

- Website: Log into your account and navigate to the card management section

- Phone: Call 1-800-227-4825 for 24/7 customer support

Capital One typically sends replacement cards via expedited shipping.

Customer Service and Contact Information

Capital One offers responsive and accessible customer service, available 24/7. You can reach support via:

- Phone (U.S.): 1-800-227-4825

- Collect Calls (International): 1-804-934-2001

- Online Chat: Available through the Capital One website or app

- Mailing Address:

Capital One

P.O. Box 30285

Salt Lake City, UT 84130-0285

Conclusion

The Capital One Venture X Rewards Credit Card is one of the most compelling premium travel cards on the market today. It combines simplicity, high-value rewards, premium benefits, and a relatively low effective annual fee. With 2X miles on every purchase, easy redemption options, a $300 travel credit, lounge access, and strong travel protections, the Venture X offers tremendous value for both frequent flyers and casual travelers.

Unlike other ultra-premium cards, it doesn’t burden users with complex reward structures or high annual fees. Instead, it delivers practical, powerful perks that enhance the travel experience—without overwhelming the user.

For anyone looking for a premium travel credit card that’s straightforward, flexible, and rewarding, the Capital One Venture X deserves a spot at the top of the list.