Capital One Venture Rewards Card: How to request, Benefits, APP, Contact

These days, credit card options are vast, but Capital One Venture Rewards stands out among many others. This card is not only a convenient payment tool, but also a gateway to a world of exclusive benefits that transform your financial experience.

Advertising

The financial journey is one we all take, and choosing the right partner on this journey can make all the difference. Every credit card has its benefits, but not all of them strike the perfect balance between rewards and features.

Advertising

As you read on, you will be presented with a detailed analysis of the benefits of this card, from airline miles to exclusive protections. Get ready for an in-depth look that will help you decide if Capital One Venture Rewards is the card your wallet is missing. Let’s embark on this adventure together?

How to Apply for the Capital One Venture Rewards Card

The Capital One Venture Rewards is one of the most sought-after credit cards for travelers due to its generous rewards and benefits. With this card, you can earn miles on every purchase and use them to cover virtually any travel expense, from airfare to hotel stays.

Advertising

Additionally, the Capital One Venture Rewards offers a range of extra perks, such as travel credits and access to exclusive events. In this guide, we will show you how to apply for the Capital One Venture Rewards quickly and efficiently.

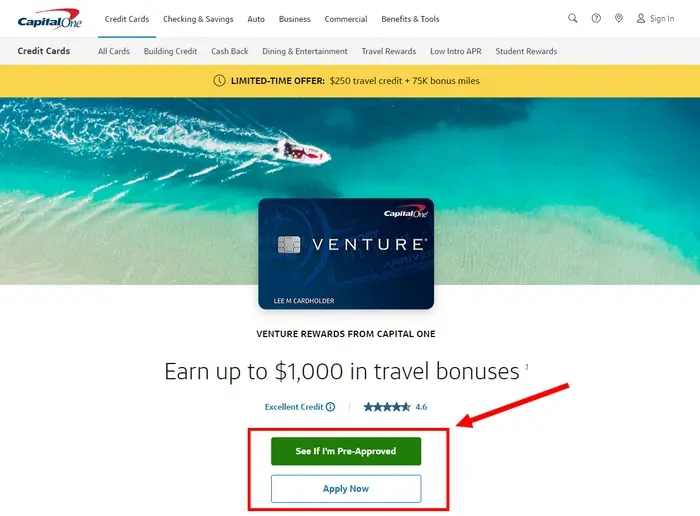

- Open your browser and go to the official Capital One website.

- Look for the credit cards section and select the Capital One Venture Rewards.

- Review the eligibility requirements. Generally, you will need a good to excellent credit history to be approved.

- On the card’s page, click the “Apply Now” button to start the application process.

- Enter your personal information, such as full name, address, and contact details.

- Provide financial information, including annual income and employment status.

- Enter details about your credit history.

- Carefully read the card’s terms and conditions.

- Make sure you understand the fees, charges, and benefits associated with the Capital One Venture Rewards.

- After reviewing all the information, click “Submit” to send your application.

- Capital One typically provides a decision within minutes. In some cases, it may take a few days for a more detailed review.

- If approved, you will receive your Capital One Venture Rewards card in the mail.

- Follow the included instructions to activate your new card.

- Use your Capital One Venture Rewards card for all your purchases and start earning miles.

- Regularly check your miles balance and explore redemption options on the Capital One website.

By following these simple steps, you can apply for the Capital One Venture Rewards and enjoy all the benefits this card offers to frequent travelers.

Benefits of the Capital One Venture Rewards Card

If you’re looking for a powerful combination of travel flexibility, savings and rewards, Capital One Venture Rewards is an unmatched choice. Check out some of the main benefits this card has to offer:

- Unlimited miles on every purchase: Earn miles for every dollar spent.

- Sign-up bonus: A generous amount of miles upon reaching an initial spend.

- Flexible redemption: Use your miles on flights, hotels, car rentals and more.

- Transfer to partners: Transfer your miles to various airline loyalty programs.

- TSA Pre✓® Application Fee Credit: Save time and stress at airports.

- No foreign transaction fees: Save on international travel.

- Purchase Protection and Extended Warranty: Feel secure with your purchases.

- Travel assistance: Be protected in emergencies during your travels.

Given this impressive list of perks, it’s no surprise that so many frequent travelers consider Capital One Venture Rewards an indispensable companion.

Does the Capital One Venture Rewards card accept negatives?

The Capital One Venture Rewards Card is generally not approved for individuals with negative credit histories. The financial institution seeks to approve applicants with a good credit history to ensure responsibility for repayment. Therefore, if you have a negative name, it may be more challenging to get approved for this card.

Card Flag

The Capital One Venture Rewards card operates on the Visa network, offering international coverage. This means that cardholders can use the card not only domestically, but also in various countries and territories around the world.

What is the annual fee for the Capital One Venture Rewards?

The annual fee for the Capital One Venture Rewards Credit Card is $95.

Capital One Venture Rewards app

With the proliferation of on-the-go lifestyles, having instant access to your account details, transaction history, and rewards balance is not just convenient but imperative. The app empowers cardholders to take control, offering a holistic view of their financial journey right at their fingertips. Whether you’re lounging at home, traveling abroad, or dashing between meetings, the ability to quickly check and manage your card’s details ensures peace of mind and enhanced financial awareness.

Moreover, in an era where security is paramount, the Capital One Venture Rewards app offers robust features to safeguard your information, swiftly report misplaced cards, and keep an eye on suspicious activities. Thus, beyond its utility, the app is a testament to Capital One’s commitment to harmonizing technological innovation with user-centric design, ensuring cardholders are always a tap away from their financial pulse.

Capital One Venture Rewards Card Contact

In the intricate world of financial services, clear, prompt, and effective communication is paramount. Capital One Venture Rewards understands this fundamental principle, placing a strong emphasis on ensuring cardholders can effortlessly reach out whenever they need assistance or have inquiries.

The dedication to seamless communication underscores Capital One’s commitment to customer satisfaction, trust, and transparency. By offering direct phone lines, Capital One reaffirms that behind every digital interface is a team of real humans, ready to help, guide, and ensure cardholders have the best possible experience.

Available Contact Numbers for Capital One Venture Rewards:

- General Customer Service: 1-800-227-4825 (CAPITAL)

- Lost or Stolen Card Reporting: 1-800-427-9428

- International Helpline: 1-804-934-2001

- Rewards Information: 1-877-383-4802

By providing these dedicated lines of communication, Capital One Venture Rewards ensures that every cardholder, whether facing an urgent issue or simply seeking clarification, has a direct pathway to the answers and assistance they need.