Capital One Venture Rewards The Ultimate Travel Card for 2025

If you’ve looked into travel credit cards in the United States, you’ve probably seen the Capital One Venture Rewards everywhere — reviews, videos, blogs, you name it. It’s a top favorite among travelers, from occasional flyers to airport regulars.

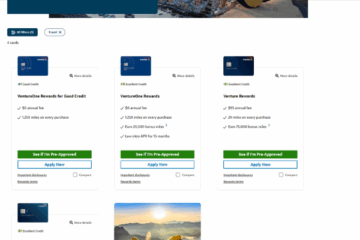

Advertising

And it makes sense. The Venture Rewards card is simple, clear, and earns miles on every purchase, which you can use for almost any travel expense — flights, hotels, Uber, or even a last-minute Airbnb.

Advertising

In this guide, you’ll learn everything about the card: how to apply, how the miles work, what they’re worth, who benefits most, the pros and cons, and whether it’s worth getting in 2025.

Advertising

How to Apply for the Capital One Venture Rewards

If you think the Venture Rewards might be the right card for you, the good news is that applying is simple and fully online. In many cases, you get a decision instantly. Still, like any credit card in the U.S., there are certain requirements and details that can increase (or reduce) your chances of approval.

Below, you’ll find everything you need to know before applying: requirements, step-by-step instructions, review time, and the main reasons applications get denied. This way, you apply with more confidence and avoid surprises.

1. Requirements to Apply

Capital One isn’t the easiest issuer to get approved with — and that’s no secret. But it’s definitely possible. They usually approve applicants who have:

- A good to excellent credit score (700+ is ideal);

- A clean credit history with no recent late payments;

- Low credit utilization (preferably under 30%);

- Stable and verifiable income.

You don’t need to be rich, but you do need to show financial responsibility.

2. Step-by-Step: How to Apply

The application is simple. Here’s how you do it:

- Go to the official Capital One website;

- Click on “Apply Now” under the Capital One Venture Rewards card;

- Fill in your information:

- Full name;

- Complete U.S. address;

- Annual income;

- Social Security Number (SSN);

- Current job and employment length.

- Review and submit your application;

- Wait for the decision (often instant).

3. How Long Does Approval Take?

Approval usually happens in one of three ways:

- Instant approval for most applicants;

- 1 to 3 business days if the system needs more time to review your information;

- Up to 10 days if additional documents are required.

4. Tips to Increase Your Chances

Before applying, it helps to follow a few simple steps:

- Pay down or reduce balances on your existing credit cards to lower utilization;

- Avoid applying for multiple cards within a short period;

- Check your credit report for any errors;

- Make sure your income and address are updated.

5. Common Reasons for Denial

If you receive that famous “we’re unable to approve you…” letter, it may be due to:

- A credit score below the recommended range;

- High credit utilization on existing cards;

- Too many recent credit applications;

- Late payments or accounts in collections;

- Income considered too low for the requested credit line.

How Does the Capital One Venture Rewards Work?

The best part about the Venture Rewards is how simple and straightforward it is. No confusing reward charts, no rotating categories, and no complicated programs that make you feel like you need a spreadsheet to figure things out.

With this card, earning miles is easy and predictable:

- 2 miles per dollar on every purchase, no exceptions;

- 5 miles per dollar on hotels and rental cars booked through Capital One Travel.

And these miles are very easy to use. You’re not tied to a single airline, don’t have to worry about blackout dates, and don’t deal with hidden rules.

You can redeem miles in two main ways:

1. Purchase Eraser

This is the most famous and most-used method. It works like this:

- You buy something travel-related (flight, hotel, Uber, rental car, etc.) with the card;

- Then you go into the Capital One app or website;

- Find the transaction and choose to “erase” it using your miles;

- Capital One reimburses the amount as a statement credit using your miles.

Simple, straightforward, and perfect for those who like full control over how they use their points.

2. Using Miles in Capital One Travel

You can also use miles directly in Capital One’s travel portal, Capital One Travel. There, you can:

- Book flights;

- Book hotels;

- Rent cars;

- Use miles as a form of payment.

Most “casual” users prefer the Purchase Eraser for its freedom, but the portal is also a great option if you like keeping everything in one place.

Main Benefits of the Capital One Venture Rewards

The Venture Rewards card packs a strong set of benefits that make it especially attractive for frequent travelers — and even for those who hit the road or fly just a few times a year. It delivers solid value, useful protections, and rewards that are easy to earn and redeem.

Here are the standout perks:

- 2x miles on everything: any purchase, anywhere, any category.

- 5x miles on hotels and rental cars booked through Capital One Travel.

- Generous welcome bonus: usually between 60,000 and 75,000 miles (depending on the current offer).

- No foreign transaction fees: zero fees on purchases outside the U.S.

- Rental car insurance: collision coverage when you pay for the rental with the card.

- Basic travel protections: includes travel accident insurance and other benefits.

- Credit for TSA PreCheck or Global Entry: up to $100 in credit every four years.

Is the Capital One Venture Rewards Worth It?

This is the question most people have — and the truth is that the value of this card really comes down to your travel habits. The Venture Rewards is designed for people who want flexibility, simplicity, and solid perks without dealing with complicated rules or premium-level fees.

It tends to be a great fit if you:

- Travel a few times a year (whether it’s flights, road trips, hotels, or Airbnb);

- Prefer a simple rewards system with miles on every purchase;

- Don’t want to rely on specific spending categories to earn points;

- Want full flexibility when redeeming miles;

- Appreciate a strong welcome bonus to offset travel costs.

But it may not be the best option if you:

- Rarely travel;

- Prefer straightforward cashback;

- Spend heavily in categories like groceries or gas and would benefit more from a category-based card.

For U.S. middle-class consumers (class C/B), it strikes a great balance: solid benefits, a reasonable annual fee, and a rewards program that’s easy to understand and delivers real value.

What Credit Score Do You Need to Be Approved for the Venture Rewards?

Capital One doesn’t publish an exact score requirement for the Venture Rewards, but in practice, the market shows a very consistent pattern. This card is a bit more selective because it offers stronger benefits and higher starting limits than basic cards — so the approval criteria naturally rise.

In general, here’s how the expected score range looks:

- 700+: excellent approval odds;

- 680+: possible approval depending on your profile;

- 640 or below: difficult approval.

These numbers aren’t official policies, but they reflect Capital One’s real behavior when evaluating applicants and determining who is ready for a card at this level.

Capital One Venture Rewards Miles: How They Work and How Much They’re Worth

One of the best things about the Venture Rewards program is how straightforward the miles are. There’s no complicated math or shifting values — the system is consistent and easy to predict.

Here’s the basic breakdown:

- 1 mile ≈ 1 cent in value

- 10,000 miles ≈ $100

- 50,000 miles ≈ $500

Because the value is fixed, you always know exactly what your miles are worth when you redeem them. No guesswork.

And the flexibility is a major plus. You can use your miles for almost any kind of travel expense, including:

- Flights

- Hotels and motels

- Uber and Lyft rides

- Rental cars

- Baggage fees

- Airport parking

- Airbnb and similar stays

In short: if it counts as travel, there’s a good chance you can cover it with Venture miles.

Capital One Venture Transfer Partners

If you want to take your miles to the next level, the Venture Rewards program gives you access to a wide network of airline and hotel partners.

This is where the card becomes especially powerful — instead of using miles only for travel purchases, you can transfer them to loyalty programs and unlock even better redemption value.

Capital One partners with several well-known airlines and hotel chains, including:

- Air Canada Aeroplan

- Avianca LifeMiles

- British Airways Executive Club

- Emirates Skywards

- Etihad Guest

- Singapore Airlines KrisFlyer

- Qantas Frequent Flyer

- TAP Miles&Go

- Choice Hotels, among others

Most transfers are made at a 1:1 ratio, which is a huge advantage for booking international premium cabins or leveraging sweet spots that stretch your miles much further than standard redemptions.

Capital One Venture Rewards Fees and Costs

Before jumping in, it’s important to understand the main costs associated with the Venture Rewards card. Nothing here is surprising, but knowing these fees upfront helps you use the card the right way:

- Annual fee: about $95 per year

- APR: variable, typically between 19% and 29% depending on your credit profile

- Cash advance: high fees and even higher interest (definitely not recommended)

Like most travel cards, the Venture Rewards isn’t designed for carrying a balance. The smart way to use it is simple: make your purchases, earn your miles, and pay the statement in full every month so you never deal with interest.

Welcome Bonus: How It Works

The welcome bonus is one of the biggest reasons people apply.

It usually works like this:

- You apply and get approved;

- Capital One sets a minimum spend for the first 3 months (e.g., $3,000);

- If you meet the requirement, you earn the bonus — typically between 60,000 and 75,000 miles;

- Then you can use those miles however you want: erasing travel purchases or booking through the portal.

This bonus alone can cover an entire domestic trip or significantly reduce the cost of an international one.

How to Maximize Your Venture Rewards Miles

If you want to get the most out of this card, don’t just leave it sitting in your wallet. You can boost your return by following a few simple strategies.

Practical Tips to Maximize

- Charge as many everyday expenses as possible to the card (bills, groceries, subscriptions — as long as you pay the statement in full);

- Use Capital One Travel to book hotels and cars and earn more miles per dollar;

- Watch for special bonus offers during certain periods;

- Transfer miles to airline partners when it gives you a better redemption value;

- Plan your first 3 months to easily hit the welcome bonus without overspending.

Is the Venture Rewards Good for International Travel?

Absolutely — and this is one of the card’s strongest advantages. For anyone who travels outside the U.S., even just once or twice a year, the Venture Rewards offers a level of convenience and savings that basic cards simply can’t match.

Here’s why it performs so well abroad:

- No foreign transaction fees: use the card in any country without paying an extra 3% on every purchase.

- Wide global acceptance: as a Visa or Mastercard (depending on the version), it works in most places worldwide.

- Travel protections: helpful coverage for certain emergencies while you’re away.

- Flexible redemption: easily erase international travel purchases using your miles, with no extra steps or restrictions.

In short, it’s a solid companion for international trips — simple, practical, and cost-efficient.

How the Venture Rewards Travel Insurance Works

The Venture Rewards travel insurance isn’t the most comprehensive on the market, but it’s a very welcome perk for a card in this annual-fee range.

It generally includes:

- Travel accident insurance when the ticket is purchased with the card;

- Rental car collision damage waiver in eligible cases of damage or theft;

- Some additional protections depending on the version and Capital One policies.

For full protection, many people pair the card with dedicated travel insurance — but what it offers already helps a lot.

If you travel frequently and want a simple, strong, and hassle-free card, the Capital One Venture Rewards is definitely worth it in 2025. It delivers solid value, great benefits, and easy-to-use points — without requiring you to become a miles expert.

And if you want to get even more out of it, you can combine it with other cards or use transfer partners to boost the value of your miles even further.