Chase Freedom Flex Card Benefits: Learn Everything to Apply

In the world of credit cards, Chase Freedom Flex stands out as a versatile option for modern consumers. Your perks aren’t just limited to offers and points; it is a financial instrument that has the potential to transform the way you spend and save.

Advertising

Over the years, the Chase Freedom Flex card has attracted a loyal following. Why? Many claim it’s due to its unparalleled combination of rewards, ease of use and access to exclusive promotions. It’s not just a credit card; it’s a window into a world of financial possibilities.

Advertising

If you’re looking for an option that offers you freedom in use, but also guarantees and tangible benefits, you’ve come to the right place. We invite you to dive deeper into this article and discover all that the Chase Freedom Flex Mastercard has to offer. Prepare to be blown away!

Benefits of the Chase Freedom Flex Card

When it comes to concrete perks, the Chase Freedom Flex doesn’t disappoint. It brings together a series of benefits designed to maximize your shopping and savings experiences. Check out the list of benefits that this card has to offer below:

Advertising

- Cashback rewards in various categories.

- Welcome bonus for new holders.

- Special introductory interest rate.

- Protection against fraud and unauthorized purchases.

- Access to exclusive events and special offers.

- No annual maintenance fee.

- 24/7 customer service.

- Flexibility in choosing the due date.

Whether for everyday use or for special moments, Chase Freedom Flex is a powerful ally in managing your personal finances. If you value direct, practical benefits, this card is certainly worth your consideration.

Chase Freedom Flex card brand

The Chase Freedom Flex card is issued under the Mastercard banner, one of the most widely accepted in physical and online establishments around the world. This means that, in addition to the specific benefits offered by the card, customers also have access to the exclusive advantages of the Mastercard flag, such as fraud protection, travel insurance, and the Mastercard Surpreenda program, which allows you to accumulate points on purchases and exchange them for products or discounts.

The brand also offers the convenience of global acceptance, ideal for those who travel frequently or make international purchases. Mastercard is recognized for its wide network of partnerships, ensuring that the Chase Freedom Flex holder has support and additional benefits almost anywhere.

What is the annual fee for the Chase Freedom Flex card?

One of the main attractions of the Chase Freedom Flex card is the annual fee waiver. This makes it an excellent option for those who want to take advantage of a versatile credit card with good rewards, without having to worry about the cost of annual maintenance.

Even without the annual fee, the card offers a robust cashback program. Customers can earn up to 5% on rotating categories (which change quarterly) and 1% on all other purchases. In addition, there are frequent welcome bonuses for new users.

It is important to remember that, despite the absence of an annual fee, other costs may apply, such as interest in the case of payment in installments or currency conversion fees on international purchases.

Does the Chase Freedom Flex card accept credit card holders?

The Chase Freedom Flex is not aimed at customers with credit history or bad credit. Like most traditional credit cards in the United States, it requires a careful credit analysis before approval. Generally, you need to have at least a good credit history (FICO Score above 670) to qualify.

For those with bad credit or a low score, alternatives such as secured cards or credit rebuilding cards may be better options. These require a security deposit, but help improve your financial history so that you can apply for cards like the Chase Freedom Flex in the future.

If you are working to improve your credit, it is advisable to avoid late payments, keep your limit utilization low and regularly monitor your score. This increases your chances of being approved for premium financial products.

Application

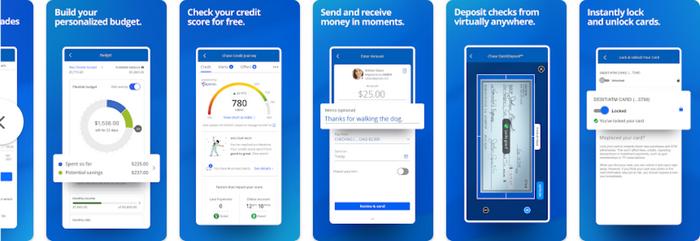

The Chase app is an essential tool for cardholders. With it, you can manage your account, check balances, check recent transactions, make payments and even track accumulated rewards in real time. Its interface is intuitive and designed to offer a fluid and pleasant user experience.

In addition, the application also has robust security measures in place to protect user information. With regular updates, the platform always seeks to innovate and bring features that make life easier for the customer, making financial management something simple and practical, even from a distance.

For those who want to have full control over their finances and make the most of the benefits of the card, the Chase Freedom Flex application is undoubtedly an essential ally.

How to access the 2nd copy of your Chase Freedom bill

Obtaining a duplicate of your credit card bill is essential for keeping payments up to date and avoiding delays. Fortunately, the process is simple and can be done through different channels, ensuring practicality and convenience.

1. Through the Bank’s App

Most card issuers offer apps to facilitate access to financial information. To access the 2nd copy of the invoice:

- Download the official app of the bank that issued your card.

- Log in with your access data.

- In the main menu, select the Invoices or Payments option.

- Choose the month you want and view or download the invoice with the barcode for payment.

2. Via the Official Website

If you prefer to use a computer:

- Access the issuing bank’s website.

- Log in to your account with your login and password.

- Find the Invoices section and choose the 2nd copy option.

3. Call Center

Another alternative is to call the customer service center, available on the back of the card, and ask for the invoice to be sent by e-mail or SMS.

With these options, you guarantee fast and secure access to the duplicate of your invoice, avoiding financial complications.

Telephone

Efficient communication is one of the priorities of JPMorgan Chase Bank, which understands the importance of keeping its customers always informed and well served. The institution offers several service channels to ensure that all doubts, problems or requests are promptly resolved. For the Chase Freedom Flex card, the main means of communication are:

- SAC – Chase Freedom Flex Service: 1-800-935-9935 .

Log on to the official Chase website for more information or to order your Chase Freedom Flex. Once approved, the card will arrive at your home within a few days. And keep watching for more information about financial products and services.