Chase Sapphire Reserve – Learn everything you need to apply.

Chase Bank, officially known as JPMorgan Chase & Co., stands as one of the largest and most respected financial institutions in the world. With roots tracing back to the Bank of the Manhattan Company, founded in 1799, Chase has evolved into a major player in the banking sector. It offers a wide array of financial services including checking and savings accounts, mortgages, investments, business banking, and an impressive lineup of credit cards. Renowned for its innovation and customer-centric services, Chase has established itself as a leading name, especially in the credit card space.

Advertising

Among its premium offerings is the Chase Sapphire Reserve, a high-end credit card tailored for frequent travelers, luxury seekers, and those who want access to premium perks. Launched as part of the bank’s strategy to attract affluent consumers, this card delivers value through travel credits, reward points, and exclusive experiences.

How to Apply for the Chase Sapphire Reserve Credit Card

Advertising

Applying for the Chase Sapphire Reserve credit card involves several important steps. Although the process is straightforward, it’s essential to ensure you meet the eligibility criteria before submitting your application. Below is a step-by-step guide:

- Check Your Credit Score

The Sapphire Reserve is a premium credit card, so Chase typically requires an excellent credit score—usually 720 or higher. It’s best to review your credit report beforehand to ensure you’re in a strong position to be approved.

Advertising

- Review the Chase 5/24 Rule

Chase generally won’t approve you if you’ve opened five or more personal credit cards (from any bank) in the last 24 months. Make sure you’re within this limit before applying.

- Gather Required Information

You’ll need the following details for the application:

- Full legal name

- Residential address

- Social Security number (SSN)

- Annual income

- Employment information

- Contact details (phone number and email)

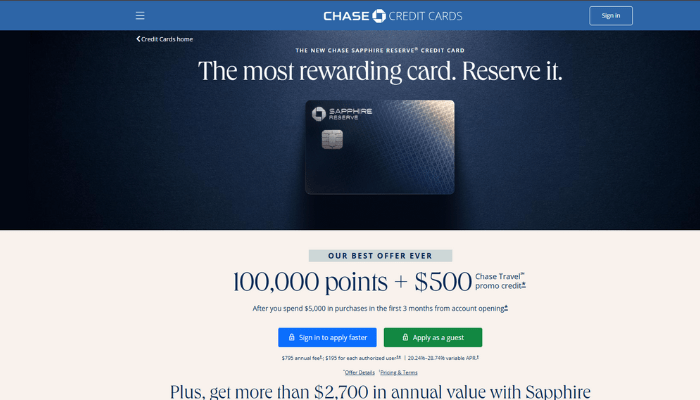

- Visit the Chase Website or Branch

The most common way to apply is online at chase.com/sapphire/reserve Alternatively, you can apply in person at a Chase branch.

- Complete the Application Form

Fill out the digital or paper form with accurate personal and financial information. Double-check everything before submitting to avoid errors that could delay your application.

- Submit and Wait for a Decision

Many applicants receive an instant decision, but in some cases, Chase may need additional time or documentation. If your application is under review, you may receive a response within 7–10 business days.

- Receive and Activate Your Card

If approved, your new Sapphire Reserve card will be mailed to your address, typically within 5–7 business days. Once received, follow the instructions to activate it online, by phone, or through the Chase Mobile app.

- Start Using and Managing Your Card

After activation, you can begin using your card immediately and monitor all your spending and rewards through the Chase website or mobile app.

What Network Does the Card Use?

The Chase Sapphire Reserve operates on the Visa network, specifically the Visa Infinite tier. Visa Infinite is Visa’s most premium category and brings a host of exclusive benefits including luxury travel upgrades, concierge service, purchase protection, and enhanced travel insurance. This makes the card not only widely accepted across the globe but also equipped with perks that cater to high-end spending and travel lifestyles.

As a Visa card, the Sapphire Reserve enjoys compatibility with nearly all merchants that accept credit cards, offering both versatility and reliability. The Visa Infinite label further elevates its stature among premium cards, making it a go-to choice for travelers and consumers seeking superior service.

What Are the Card Fees?

Despite its numerous benefits, the Chase Sapphire Reserve comes with significant fees. The most notable is the $550 annual fee, which reflects the card’s premium positioning. This annual fee, however, is partially offset by a $300 annual travel credit that automatically applies to eligible travel purchases.

There are no foreign transaction fees, making the card ideal for international use. However, the card carries a variable APR ranging between 22.49% and 29.49%, depending on the user’s creditworthiness. Additional costs may include a $75 fee for each authorized user and standard fees for cash advances or late payments.

While the annual fee might deter some users, those who travel frequently or spend heavily on dining and transportation often find that the rewards and credits easily compensate for the cost.

What Are the Main Benefits of the Amex Cobalt Credit Card?

Although the focus here is on Chase, it’s worthwhile to compare with another notable premium credit card: the American Express Cobalt. Though more popular in Canada, the Amex Cobalt has gained attention for its generous rewards and flexible redemption options.

Cardholders earn elevated points on categories like dining, food delivery, streaming services, and public transportation. Points can be redeemed for travel through Amex’s portal, or transferred to frequent flyer programs for better value. The card also offers travel and rental car insurance, and access to exclusive Amex events and promotions.

While the Cobalt is not a direct competitor to the Sapphire Reserve in the U.S., it appeals to a younger demographic focused on lifestyle rewards rather than pure luxury travel. Both cards offer valuable perks, but they cater to slightly different audiences.

How to Download the Chase Sapphire Reserve Mobile App

Managing the Chase Sapphire Reserve card is easy with the Chase Mobile App, available on both Android and iOS. The app offers a seamless user experience, allowing cardholders to monitor transactions, view reward balances, pay bills, lock or unlock the card, and even request support.

To get started, users simply need to search for “Chase Mobile” in the App Store or Google Play, download the app, and sign in with their Chase credentials. The app enables secure, real-time management of all Chase banking and credit card services, making it an essential tool for cardholders.

How to Request a Replacement Chase Sapphire Reserve Card

Losing or damaging your credit card can be stressful, but Chase makes the replacement process straightforward. If a card is lost, stolen, or no longer functional, cardholders can request a replacement through the Chase Mobile App, the official website, or by contacting customer service.

Within the app, users can navigate to their card details, tap the “Replace a Card” option, and confirm the delivery address. Alternatively, logging into their online account provides the same feature. For urgent issues, calling Chase’s dedicated credit card support line will often result in expedited shipping, sometimes with delivery within 1–2 business days.

Security is a priority during this process. If fraud is suspected, Chase will immediately deactivate the compromised card and issue a new one with a different number, ensuring the account remains secure.

Contacts for the Chase Sapphire Reserve Credit Card

For questions or support related to the Sapphire Reserve, cardholders have multiple contact options. The main customer service number within the United States is 1-800-432-3117, available 24/7. For international calls, the number is 1-302-594-8200 (collect calls accepted). Chase also offers a dedicated line for hearing-impaired customers: 1-800-242-7383 (TTY/TDD).

Mail correspondence can be directed to:

- Cardmember Services

P.O. Box 15298

Wilmington, DE 19850

Support is also available through the mobile app and online chat, both of which are responsive and equipped to handle most service requests, including billing inquiries, travel notifications, and fraud alerts.

The Chase Sapphire Reserve is a powerful credit card designed for individuals who value travel, luxury, and financial flexibility. While the card does carry a high annual fee, it offers an equally high level of value through perks such as the $300 annual travel credit, Priority Pass airport lounge access, enhanced points earning on travel and dining, and top-tier travel protections.

It also stands out for its Visa Infinite benefits and integration with the Chase Ultimate Rewards program, which allows for flexible and rewarding points redemption. With a robust mobile app, excellent customer service, and a reputation for delivering a premium experience, the Chase Sapphire Reserve continues to rank among the top-tier cards for discerning consumers.

For those who meet the credit and financial qualifications, this card can be a valuable asset, providing both tangible and experiential returns. Whether used for luxury travel, fine dining, or everyday convenience, the Sapphire Reserve delivers a refined and rewarding credit card experience.