Citi Custom Cash card: How to apply, Best Benefits and More Customer Services

With a significant presence in several countries, Citibank offers a wide range of financial products and services to meet the needs of its customers, from personal and commercial banking to investment management and credit cards.

Advertising

Its reputation for innovation and commitment to customer satisfaction makes Citibank a trusted choice for millions of people around the globe.

Advertising

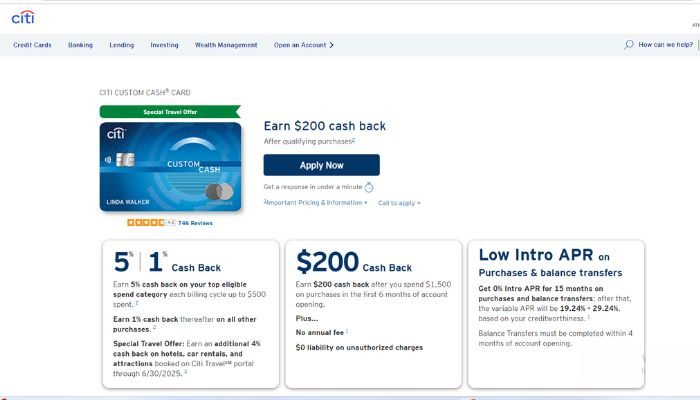

The Citi Custom Cash Credit Card is one of the latest additions to Citibank’s product line, designed to offer customers a personalized and rewarding credit experience. With a focus on flexibility and convenience, Citi Custom Cash offers cardholders the opportunity to earn rewards in categories that most closely align with their lifestyle and spending habits.

How to apply for the Citi Custom Cash card

Applying for the Citi Custom Cash Credit Card is a simple and accessible process. Interested parties can start the application process online by visiting the official Citibank website, where they will be guided through an intuitive application form. During the application process, applicants will be asked to provide personal information such as name, address, employment and income.

Advertising

After submitting the application form, Citibank will carry out a credit analysis to determine the applicant’s eligibility for the Custom Cash Card. This process usually only takes a few minutes, and applicants will be notified of the approval or rejection of their application shortly.

- Visit the Citi Website: Go to the official Citi website.

- Select the Card: Find and click on the Citi Custom Cash Card.

- Click on “Apply Now”: Start the application process.

- Fill Out the Form: Enter your personal and financial information.

- Review the Terms: Read the terms and conditions.

- Submit the Application: Click “Submit” to send your application.

- Wait for a Response: Wait for approval, which can be immediate or take a few days.

- Activate the Card: Follow the instructions to activate your card upon receipt.

Which Card Flag

The Citi Custom Cash Credit Card is issued under the Visa brand, one of the most widely recognized and accepted payment brands in the world. With Visa, Citi Custom Cash cardholders can enjoy the convenience and accessibility of using their card at millions of merchants worldwide, both online and in physical stores.

What are the Card’s Annuity Fees?

One of the distinctive features of the Citi Custom Cash Credit Card is the no annual fee. This means that cardholders can enjoy the benefits of Custom Cash without worrying about additional recurring costs. In addition, Citibank offers a variety of other charges and fees associated with using the card, such as late fees or cash advance fees.

Main Benefits

Citi Custom Cash is a card that adapts to the user’s lifestyle, offering rewards that align with consumption habits. Whether it’s for everyday purchases, travel or entertainment, the card provides benefits that fit individual needs.

The Citi Custom Cash Credit Card offers a number of benefits designed to enhance the cardholder experience and reward their spending habits. Some of the key benefits include:

- Personalized rewards: With Citi Custom Cash, cardholders can earn rewards in categories that most closely align with their lifestyle and spending, such as groceries, restaurants, travel and more;

- No limit on rewards: There is no limit to the amount of rewards Custom Cash holders can earn, allowing them to accumulate rewards quickly and without restrictions;

- Fraud protection: Citibank offers comprehensive protection against fraudulent activity on your card, ensuring that cardholders are protected against unauthorized charges.

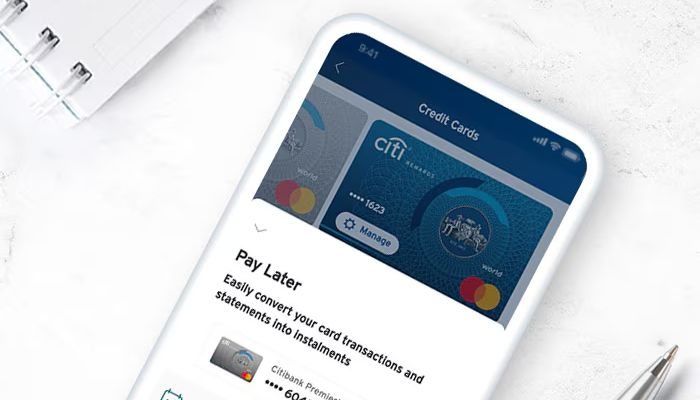

How to Download the Application

To conveniently access and manage their Citi Custom Cash Credit Card, cardholders can download the Citi Mobile app. Available for free on the App Store and Google Play Store, the app offers a variety of useful features, including quick access to account balance, transaction history and bill payment.

Citibank strives to ensure that the customer experience is smooth and convenient. With an intuitive app and 24-hour customer service, Citi Custom Cash cardholders have complete control over their finances and support whenever they need it.

How to Check Your Citi Custom Cash Bill

Checking your Citi Custom Cash bill is simple and convenient. You can access your bill online via the Citibank customer portal or the mobile app. On these channels, you’ll have access to a complete breakdown of all your purchases, payments and outstanding balance. In addition, you can set up alerts to receive notifications about invoice due dates and other important activities on your card.

How to Unlock Your Citi Custom Cash Card

If your Citi Custom Cash card is blocked, you can quickly unblock it via the mobile app or by calling Citibank customer service. When you get in touch, you’ll need to provide your security information to confirm your identity and unblock the card. It’s important to have your card number and other relevant information at hand to speed up the process.

How to request a duplicate card

If the Citi Custom Cash Credit Card is lost or stolen, cardholders can request a duplicate by contacting Citibank customer service by phone, visiting a local branch or via the Citi Mobile mobile app.

Citi Custom Cash Credit Card Contacts

For more information about the Citi Custom Cash Credit Card or for assistance, cardholders can contact Citibank customer service through the following channels:

- Online Chat: Available on the official Citibank website

- Local Branch: Visit a Citibank branch near you

The Citi Custom Cash Credit Card offers a convenient and rewarding solution to consumers’ credit needs, with a variety of benefits and features designed to enhance their financial experience.

With personalized rewards, fraud protection and convenient access to the Citi Mobile app, Custom Cash is a solid choice for anyone looking for a flexible and rewarding credit card. To apply for your own Custom Cash Card and start enjoying its benefits, contact Citibank today.