Citi Strata Premier: the flexible, economical card packed with exclusive benefits.

Citibank, a division of the multinational financial services corporation Citigroup, is one of the most established banking institutions in the world. Known for its expansive global presence, Citi offers a broad array of financial products, including checking and savings accounts, investment services, loans, and a diverse lineup of credit cards.

Advertising

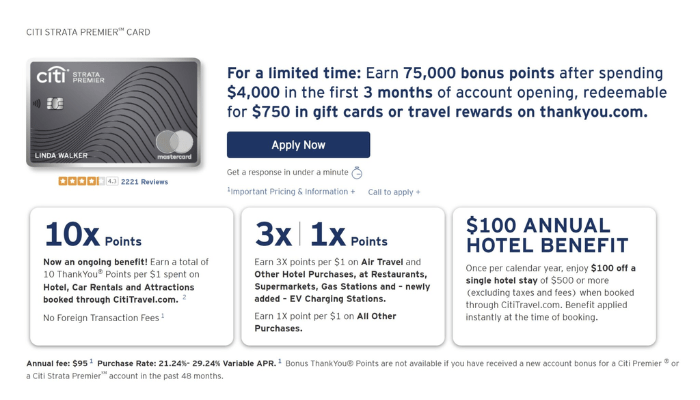

Citi’s credit card portfolio is especially competitive, ranging from cashback and balance transfer cards to premium travel rewards options. One of its most talked-about products in the travel rewards space is the Citi Strata Premier Credit Card—previously referred to as Citi Strata Elite. This card is ideal for those who travel frequently, dine out often, and want a card that offers value both at home and abroad.

How to Apply for the Citi Strata Premier℠ Card

Advertising

Applying for the Citi Strata Premier card is simple, but like any premium-tier product, approval is subject to a credit review. Here’s a step-by-step outline of the application process:

- Check Your Credit Score

Citi typically requires a good to excellent credit score (usually 700 or higher). It’s a good idea to review your credit report beforehand to ensure there are no surprises. - Visit the Citi Website

Go to www.citi.com and navigate to the credit cards section. Select the Strata Premier card and click “Apply Now.” - Complete the Online Application

You’ll be prompted to enter personal details including your full name, address, income, employment status, Social Security number, and contact information. - Submit and Wait for Approval

In many cases, Citi offers instant decisions. However, some applications may require further review, especially if credit history is limited or there are inconsistencies. - Receive and Activate Your Card

If approved, you’ll receive the card by mail within 7–10 business days. Activation can be done online or via the Citi Mobile app.

Network and Acceptance

The Citi Strata Premier is issued on the Mastercard® network, which guarantees global acceptance in over 210 countries. Mastercard is one of the most widely accepted payment networks in the world, making this card a reliable option for international travel and everyday purchases.

Advertising

Additionally, Mastercard provides core benefits such as extended warranty, identity theft protection, and access to the Mastercard Travel & Lifestyle Services platform, which offers hotel upgrades, concierge service, and more.

Annual Fees and Other Charges

The annual fee for the Citi Strata Premier card is $95, which is modest considering the earning potential and travel-related perks the card offers. Here’s a breakdown of the primary costs:

- Annual fee: $95 (waived in some targeted offers for the first year)

- Foreign transaction fees: None

- APR: Variable APR currently ranges between 21.24% to 29.24%, depending on creditworthiness

- Late payment fee: Up to $41

- Cash advance fee: Either $10 or 5% of the transaction amount (whichever is greater)

Overall, the card offers great value for frequent travelers without the burden of a hefty annual cost.

Rewards Structure and Benefits

The Citi Strata Premier card is centered around the Citi ThankYou Rewards program, one of the more flexible and versatile rewards systems among major issuers.

Points Earning:

- 3X ThankYou Points on:

- Air travel

- Hotels

- Restaurants

- Supermarkets

- Gas stations

- 1X Point on all other purchases

These categories align closely with common everyday and travel-related expenses, making it easy to accumulate points quickly.

Redemption Options:

- Travel bookings via the Citi ThankYou Travel Center

- Point transfers to over a dozen airline loyalty programs, including Avianca LifeMiles, JetBlue TrueBlue, Singapore Airlines KrisFlyer, and more

- Cashback and gift cards

- Online purchases at Amazon and PayPal using Shop with Points

One of the biggest advantages of the ThankYou® program is the ability to transfer points to international airline partners, which can offer outsized value when booking business or first-class flights.

Additional Travel Perks

While the Citi Strata Premier℠ card doesn’t come with lounge access or luxury hotel benefits like some higher-end cards, it still offers strong travel protections and global convenience:

- Trip cancellation and interruption protection

- Lost baggage protection

- Worldwide car rental insurance

- Mastercard Concierge services

- Mastercard World Elite® travel discounts

For a $95 card, these features represent a high value, especially for frequent travelers who prefer flexibility over luxury.

Managing Your Account with the Citi Mobile® App

The Citi Mobile® app makes managing your Citi Strata Premier℠ card easy and intuitive. Available for both Android and iOS, the app allows you to:

- Track spending in real time

- Redeem ThankYou® Points

- Make payments and set up autopay

- Get alerts and fraud protection

- Lock and unlock your card instantly

The app also integrates Citi’s Virtual Account Numbers feature, which lets you create temporary card numbers for safer online shopping, adding an extra layer of security to your digital life.

How to Request a Replacement Citi Strata Card

If your Citi Strata Premier℠ card is lost, damaged, or stolen, getting a replacement is simple:

- Online: Log in to your Citi account and request a replacement under the “Services” tab.

- App: Use the Citi Mobile® app to report the issue and request a new card.

- Phone: Call Citi customer service at 1-800-950-5114 (24/7 support).

Replacements are typically shipped within 3–5 business days, and expedited delivery is available upon request.

Customer Support and Contact Information

Citi provides 24/7 customer support for all credit card services. You can reach them through:

- Phone: 1-800-950-5114 (within the U.S.)

- International Collect: 1-605-335-2222

- Online Chat: Available via your logged-in Citi dashboard

- Website: www.citi.com

Whether you need help redeeming points, disputing a charge, or replacing your card, Citi’s customer service team is known for being helpful and efficient.

Conclusion

The Citi Strata Premier Credit Card is a well-rounded travel rewards card that offers generous bonus categories, flexible redemption options, and solid travel protections—all for a reasonable annual fee of $95. With 3X points on key spending categories like air travel, dining, gas, and groceries, cardholders can earn meaningful rewards quickly.

The card’s connection to the Citi ThankYou Rewards program also adds long-term value, especially for travelers who want the flexibility to transfer points to airline partners. While it lacks luxury perks like airport lounge access, it more than makes up for it with practical, easy-to-use rewards and low fees.

If you’re looking for a powerful travel card that delivers strong value without premium-level costs, the Citi Strata Premier℠ deserves serious consideration.