MBNA Rewards World Elite Card: How to apply, Best Benefits and More Customer Services

The MBNA Rewards World Elite Card is an exceptional choice for individuals looking to maximize their rewards on everyday purchases. This premium card offers a variety of benefits, including competitive points accumulation, travel perks, and comprehensive insurance coverage, making it ideal for frequent travelers and savvy spenders alike.

Advertising

In addition to its impressive rewards program, the MBNA Rewards World Elite Card provides outstanding customer services, ensuring cardholders receive the support they need. Whether you’re looking to redeem points, manage your account, or access exclusive offers, this card delivers a top-tier experience.

Get to know the MBNA Rewards World Elite card

Advertising

The MBNA Rewards World Elite Card is one of the most prestigious options on the Canadian credit card market, designed to meet the expectations of the most demanding consumers. This card is not just a means of payment, but a portal to a world of privileges and rewards.

With a focus on offering exceptional value, MBNA Rewards World Elite stands out for its generous rewards program. Cardholders earn points for every dollar spent on everyday purchases, which can be redeemed for a variety of rewards including travel, merchandise, statement credits and more.

Advertising

In addition to the points program, this card offers a series of additional benefits. Cardholders have access to comprehensive travel insurance, which may include coverage for trip cancellation, trip interruption, and car rental insurance. This provides greater peace of mind, especially for those who travel frequently.

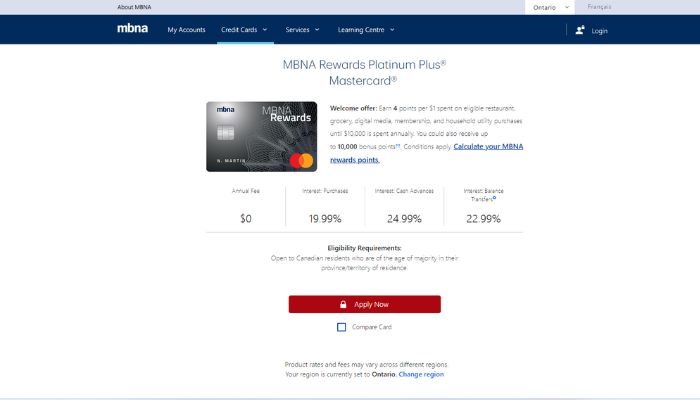

How to request the card MBNA Rewards?

The MBNA Rewards credit card is perfect for those looking to earn points on everyday purchases. With flexible reward options, including travel, gift cards, and cashback, this card offers valuable benefits tailored to your needs.

- Visit the MBNA Website: Go to the official MBNA website.

- Select the Card: Choose the MBNA Rewards Platinum Plus card.

- Complete the Application: Fill out the online form with your personal and financial details.

- Submit the Application: Review your information and submit your application.

- Wait for Approval: MBNA will review your application and notify you of the decision.

Follow these steps to start enjoying the benefits of the MBNA Rewards card.

Main benefits of the MBNA Rewards Card

The MBNA Rewards card offers a number of benefits that can make your life easier and more enjoyable. Some of the main benefits include:

- Points Accumulation: The main advantage of the MBNA Rewards card is the possibility of accumulating points with every purchase made. These points can be exchanged for a variety of rewards, such as airline tickets, electronics, unique experiences and much more.

- Travel Programs: Many MBNA Rewards cards offer exclusive travel programs, with access to VIP lounges at airports, comprehensive travel insurance and discounts at hotels and partner airlines.

- Flexibility: MBNA offers a variety of cards to choose from, each with personalized benefits to suit your needs. Whether you’re a frequent traveler, a technology lover or simply looking for a card that offers more flexibility, you’re sure to find the perfect option for you.

- Purchase Protection: Some MBNA Rewards cards offer purchase protection, which guarantees the replacement or refund of the value of products purchased with the card in the event of theft, loss or damage.

- Travel Insurance: MBNA Rewards cards often include travel insurance that covers medical expenses, lost luggage and other unforeseen events that may occur during your travels.

- 24-hour assistance: MBNA offers a 24/7 customer service to help its customers in case of questions or emergencies.

Annual fee

The annual fee for the MBNA Rewards credit card can vary depending on the type of card you choose and the promotions in force. Some cards offer the first year with no annual fee for new customers, while others may have higher fees. It’s important to compare the different options and choose the one that best fits your profile and budget. When applying for a card, make sure you check all the information about the annual fee and the conditions for exemption.

Many banks offer the possibility of deducting the annual fee by accumulating points or by making minimum spending on the card. This is a great way to save money and enjoy the benefits of your card even more.

Interest and Fees

MBNA Rewards card interest and fees can also vary according to the type of card and the terms of the contract. It is essential to read the contract carefully before accepting the terms to understand all the charges involved, such as revolving interest, installment fees, late fees and others.

When using a credit card, it is important to plan your spending and avoid accumulating debt, as the interest can be high and compromise your budget. If you can’t pay the full amount of the bill, try to negotiate with the bank to find the best way to settle the debt and avoid default.

Coverage

The coverage of the MBNA Rewards card can include a variety of benefits, such as travel insurance, purchase protection, cell phone insurance and travel medical assistance. The extent and details of the coverage may vary depending on the type of card chosen and the plan contracted.

It’s important to check what cover is included on your card and how to access it if you need it. Some coverages may require you to pay an additional amount or meet certain requirements.

Flag

The MBNA Rewards card is usually issued under the Visa or Mastercard brand. The choice of brand can influence the acceptance of the card in commercial establishments and the availability of additional benefits and services.

Each brand has its own network of partners and offers exclusive advantages to its customers. When choosing an MBNA Rewards card, consider which brand best suits your needs and preferences.

How to Check Your Bill

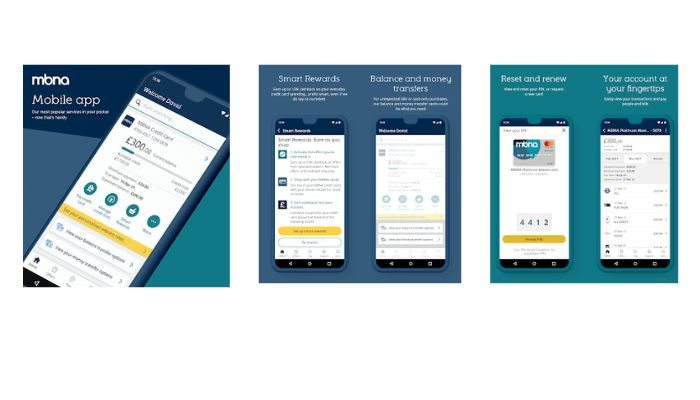

To check your MBNA Rewards card bill, you can access your account online via the bank’s website or app. In this restricted area, you will have access to a complete breakdown of all your purchases, payments and outstanding balance.

In addition, many banks send out invoices by email or post. It is important to keep your details up to date in order to receive your bill on time and avoid late payments.

How to Unblock Your Card

If your MBNA Rewards card is blocked, you can unblock it in several ways. The quickest and most practical way is to contact the bank’s customer service via phone or app. You will need to provide your personal details and security information to confirm your identity and request that the card be unblocked.

Some banks also allow you to unblock your card via the app by following the instructions. It’s important to have your card number and other relevant information to hand to speed up the process.

Does the card have a free annual fee?

Does MBNA Rewards World Elite have an app?

MBNA Rewards World Elite Contact

Here are the MBNA Bank Canada contacts:

- Telephone: 1-888-876-6262

- TDD: 1-800 -872-5758

- FAX: 1-800-439-5491

- Address: MBNA Canada, PO Box 9614, Ottawa, ON K1G 6E6

You can also contact MBNA Bank Canada via live chat on their website. Live chat is available Monday through Sunday from 9am to 9pm Eastern Time.