The Blue Card from American Express: A Complete Guide

American Express, often shortened to Amex, is a globally recognized financial services corporation best known for its premium credit and charge cards. Founded in 1850, Amex originally started as an express mail business before transitioning into financial services. Today, it stands as one of the most prestigious credit card issuers in the world, offering exclusive benefits and luxury experiences to its cardholders.

Advertising

Among its suite of premium products, The Card from American Express holds a distinguished reputation. This card is not just a status symbol—it’s a gateway to luxury travel, elite rewards, and high-level concierge services. For those who travel often or value exclusive perks, the Platinum Card delivers a level of access and service few cards can match.

Advertising

American Express continuously updates the features of the Platinum Card to meet the changing needs of high-income consumers, frequent travelers, and business executives. From airport lounge access to statement credits, the card has become synonymous with a high-end lifestyle.

How to Apply for the Amex Card

Applying for the Platinum Card is a relatively straightforward process, but approval depends heavily on your financial profile. Here’s a simple step-by-step guide to help you understand the application process:

Advertising

- Check Your Credit Score: A high credit score (typically 700 or above) is required for approval. American Express looks for applicants with excellent credit histories and strong financial habits.

- Gather Your Financial Information: You’ll need to provide details such as your full legal name, home address, income, employer information, Social Security number, and contact information.

- Visit the American Express Website: Go to americanexpress.com and navigate to the Platinum Card section. Click on “Apply Now” and begin the application form.

- Complete the Application: Fill out all required fields accurately. American Express may pre-approve some applicants based on their credit history or prior relationship with the company.

- Wait for a Decision: In many cases, Amex will give you an instant decision. If not, they may request additional documentation or further verification.

- Receive and Activate Your Card: Upon approval, you’ll receive the Platinum Card by mail within 3–5 business days. Activation can be done online or through the Amex app.

Card Network and Acceptance

The Platinum Card is issued under the American Express network, which, while slightly less widespread than Visa or Mastercard globally, is still accepted at millions of merchants around the world, especially in the U.S., Europe, and major urban centers.

American Express invests heavily in partnerships and global expansion, so acceptance continues to grow year by year. Moreover, Amex cards are often favored by upscale retailers, luxury hotels, and service providers due to the high-spending profile of cardholders.

Annual Fees and Other Costs

The annual fee for the American Express Platinum Card is $695 (as of 2025). This may seem steep at first glance, but the card is packed with benefits that can easily offset this cost for the right user. Here are some of the other relevant fees and charges:

- No foreign transaction fees, making it ideal for international travel.

- Late payment fee: Up to $40.

- Returned payment fee: Up to $40.

- Pay Over Time APR: Variable, currently around 21.24% to 29.24%, depending on your credit profile and Amex policies.

Because it’s a charge card, the balance must usually be paid in full each month. However, eligible purchases can be paid over time with interest through the Pay Over Time feature, subject to approval.

Key Benefits of the Platinum Card

The American Express Platinum Card is most valuable when the cardholder takes full advantage of its extensive benefits. Below are some of the standout features:

1. Airport Lounge Access

The Platinum Card grants access to over 1,400 airport lounges worldwide, including:

The Centurion® Lounge

Priority Pass™ Select (upon enrollment)

Delta Sky Clubs (when flying Delta)

Escape Lounges and Airspace Lounges

This perk alone is worth hundreds of dollars for frequent travelers.

2. Travel Credits

$200 Airline Fee Credit: Reimburses incidental airline charges (baggage fees, seat selection, etc.).

$200 Hotel Credit: Annual credit when booking with Fine Hotels + Resorts® or The Hotel Collection through Amex Travel.

$189 CLEAR® Credit: For faster airport security clearance.

$240 Digital Entertainment Credit: For streaming services like Disney+, Hulu, and others (requires enrollment).

$300 Equinox Credit: For qualifying Equinox memberships or app access.

3. Hotel and Airline Perks

Hilton Honors Gold and Marriott Bonvoy Gold Elite status (upon enrollment).

Special upgrades, late check-out, and complimentary breakfast at select hotels.

5x Membership Rewards® points on flights booked directly with airlines or through Amex Travel.

4. Comprehensive Travel Insurance

Coverage includes trip cancellation/interruption insurance, lost luggage reimbursement, rental car insurance, and emergency assistance—ideal for international travelers.

5. Concierge and Platinum Services

Cardholders can access 24/7 concierge services for restaurant reservations, event planning, gifts, and more.

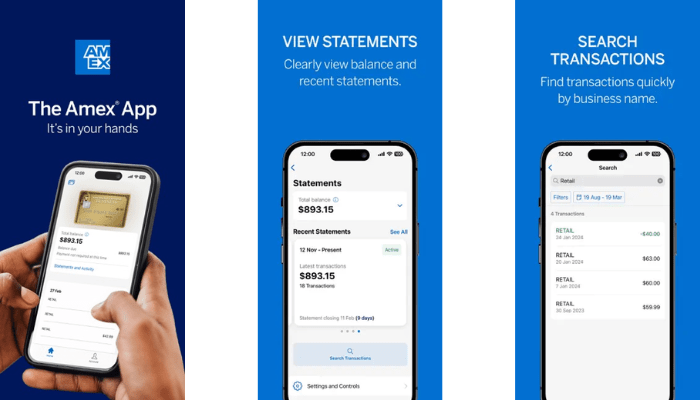

Using the Amex App to Manage Your Card

The American Express mobile app is a powerful tool that gives you full control over your Platinum Card account. Available on Android and iOS, it allows you to:

- View statements and transactions

- Track rewards and membership points

- Make or schedule payments

- Set up alerts and spending limits

- Chat with customer service

- Redeem points for flights, gift cards, and more

The app also supports Amex Offers, which are targeted discounts and cashback opportunities across various retailers and categories. These offers can add significant value throughout the year.

How to Request a Replacement Platinum Card

If your card is lost, stolen, or damaged, American Express makes it easy to request a replacement:

- Online: Log into your Amex account and navigate to the “Card Management” section. Select “Replace Card.”

- Mobile App: Use the same option in the app for quicker processing.

- Phone: Call Amex Customer Service at 1-800-528-4800 (24/7 availability).

In most cases, replacement cards are shipped via overnight delivery within the U.S., and international delivery is available for travelers abroad.

Customer Support and Contact Information

American Express is known for its top-tier customer service. For Platinum Card support, you can contact:

- Phone (U.S.): 1-800-528-4800 (Platinum Customer Care)

- International Collect: +1-336-393-1111

- Website: americanexpress.com

- Live Chat: Available through the mobile app or website after logging in

In addition to traditional customer service, Platinum Card members also have access to dedicated travel counselors, concierge services, and fraud protection teams, offering peace of mind with every purchase.

Conclusion

The Platinum Card® from American Express is much more than a piece of metal—it’s a lifestyle tool built for those who value experiences, exclusivity, and seamless service. While the card carries a high annual fee, the benefits—particularly for travelers—can far exceed the cost when used to their full potential.

With unmatched airport lounge access, generous travel and lifestyle credits, elite hotel and airline statuses, and a trusted mobile platform for daily use, the Platinum Card sets the standard for what a premium charge card should be. Whether you’re a frequent flyer, a business traveler, or someone who simply enjoys top-tier service, the Amex Platinum Card is one of the most rewarding tools available in the world of personal finance.