Scotia Momentum Card: How to apply, Benefits, Contact

In the dynamic financial world, credit cards emerge as indispensable tools in day-to-day financial management. Among them, Scotia Momentum stands out, a banking product that has gained a position of prestige and trust among Canadian consumers. This card is not only a convenient means of payment, but also a symbol of security and efficiency, adapting to the diverse needs of the population.

Advertising

The popularity of Scotia Momentum can be attributed to a combination of factors. Its innovative features, combined with a well-thought-out rewards and benefits structure, make it an attractive choice for a wide range of consumers. From individuals looking for a simple solution for everyday transactions to those looking to maximize their rewards and benefits, Scotia Momentum has something to offer for everyone.

Advertising

Furthermore, its usefulness extends beyond Canadian borders, offering its users the flexibility and freedom necessary when traveling internationally. This global reach, combined with the security and support offered, reinforces Scotia Momentum’s position as one of the most respected credit cards in the world. In this text, we will explore the various facets of Scotia Momentum, uncovering the secrets behind its popularity and usefulness.

How to request the card?

The Scotiabank Momentum credit card is ideal for those seeking cash back on everyday purchases. With impressive cashback rates on groceries, gas, and recurring payments, this card helps you maximize your savings effortlessly.

Advertising

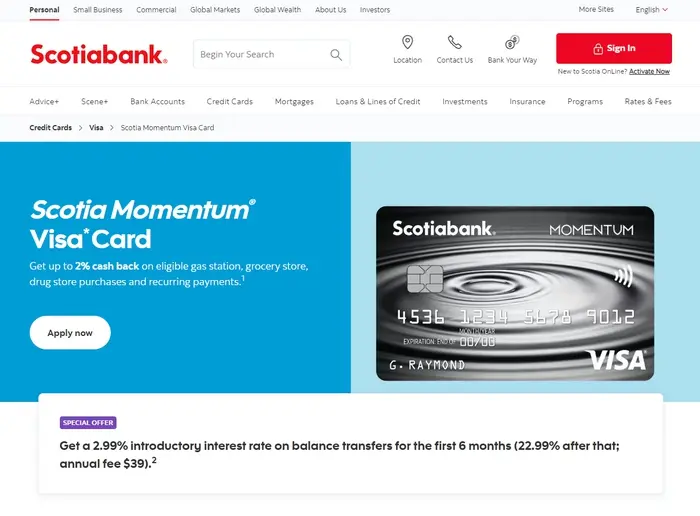

- Visit the Scotiabank Website: Go to the official Scotiabank website.

- Select the Card: Choose the Scotiabank Momentum Visa Infinite card.

- Complete the Application: Fill out the online application form with your personal and financial information.

- Submit the Application: Review your details and submit your application.

- Wait for Approval: The bank will review your application and contact you with the decision.

Follow these steps to start enjoying the benefits of the Scotiabank Momentum card.

Discover the Scotia Momentum card

The Scotia Momentum Card is an innovative financial product issued by Scotiabank, one of Canada’s most renowned banking institutions. This credit card stands out for offering a balanced combination of flexibility, security and rewards, making it an ideal choice for a wide range of consumers.

Basic features of Scotia Momentum include a highly competitive cashback structure, which allows users to receive a percentage of the value of their purchases in return. This feature is particularly attractive for those looking to maximize the value of their everyday expenses. In addition, the card offers a series of additional benefits, such as travel insurance and extended warranties on purchases, expanding its appeal among consumers who value security and protection.

Another strong point of Scotia Momentum is its accessibility. Designed to serve both students and young professionals as well as more established consumers, it offers different credit ranges and interest rates, thus adapting to different financial profiles. This flexibility ensures that a wide range of customers can enjoy the card’s benefits, regardless of their background or financial situation.

In the competitive credit card market, Scotia Momentum stands out for its relevance and popularity. Its presence is significant due to the trust it inspires in consumers, a direct reflection of Scotiabank’s strength and reputation. Furthermore, the card continues to evolve, incorporating new technologies and adapting to changing consumer demands, aspects that further solidify its position as one of the leading credit cards.

Benefits of the Scotia Momentum Card

The Scotia Momentum card is not just a means of payment, but a financial tool that offers a range of significant benefits to its users. Here are the main benefits in list:

- Generous Cashback: The card offers one of the best cashback systems on the market, allowing users to receive back a significant percentage of the amount spent on eligible purchases.

- Included Insurance: Includes a variety of insurances, such as travel insurance, car rental insurance and purchase insurance, providing peace of mind and security in different situations.

- Flexible Rewards Program: In addition to cashback, the card offers a rewards program that allows users to exchange points for a variety of rewards, from products to exclusive experiences.

- No International Fees: Ideal for travelers as it does not charge additional fees on international transactions, making it an economical option for purchases abroad.

- Access to Exclusive Promotions: Scotia Momentum users have access to exclusive offers and promotions, including discounts at partner stores and services.

- Ease of Online Management: With a robust online management system, users can easily check balances, transactions and manage their accounts from anywhere.

- Excellent Customer Service: Scotiabank is known for its high-quality customer service, offering fast and efficient support to resolve any card-related issues or questions.

- Contactless Payment Technology: The card is equipped with contactless technology, allowing fast and secure payments with just one touch.

- Customizable Credit Limit: Depending on the customer profile, the credit limit can be adjusted to meet individual needs, providing greater financial control.

- Enhanced Security: Includes advanced security features, including fraud protection and constant monitoring to prevent unauthorized activity.

Who can apply for the Scotia Momentum credit card?

The Scotia Momentum Credit Card is an affordable option for many consumers, but like all financial products, it has specific eligibility criteria that interested parties must meet. Let’s explore these criteria and the application process.

Eligibility Criteria

- Minimum Income: To be eligible for the Scotia Momentum card, applicants generally need to demonstrate a minimum annual income. This requirement varies depending on the specific type of Scotia Momentum card chosen. The minimum income ensures that applicants have the financial capacity to manage their credit responsibilities.

- Credit History: A positive credit history is crucial for approval. Scotiabank will review the applicant’s credit history to assess their repayment capacity and past financial behavior. This often includes checking for timely payments on existing debts and the absence of significant negative records.

Application Process

Completing the Request Form: Interested parties must start the process by filling out a request form. This form can be found on the Scotiabank website or at one of its branches. The form requires personal, financial and employment information.

- Document Verification: Applicants may need to provide documents proving their income and identity, such as pay stubs, income tax returns, and identification documents.

- Credit Analysis: After submitting the form and necessary documents, Scotiabank will carry out a credit analysis. This step is crucial in determining the candidate’s eligibility.

- Card Decision and Issuance: If approved, the applicant will receive a notification, and the credit card will be issued and sent by mail. The total time from application to card receipt may vary.

- Card Activation: Once received, the card must be activated before use. This can be done online or over the phone.

By fulfilling these criteria and following the application process, interested parties can become holders of the Scotia Momentum Credit Card, taking advantage of all the benefits it offers.

Does the Scotia Momentum card have a free annual fee?

The annual fee for the card is CAD $99 per year. However, you can get an annual fee refund if you spend at least CAD$50,000 on purchases on the card each year.

Does Scotia Momentum have an app?

Scotia Momentum, aligned with current technological trends, offers its users the convenience and efficiency of a mobile application. This application is an essential tool for efficient card management, providing a series of features and benefits.

- Balance Check and Transactions: Users can quickly check their current card balance and review recent transactions, making it easier to track spending.

- Payments and Transfers: The application allows you to make credit card payments and transfer funds between accounts in a simple and secure way.

- Real-Time Notifications: Users receive instant notifications about suspicious activity, due payments or other important card-related information.

- Rewards Management: Allows users to track and redeem their accumulated rewards, such as cashback or loyalty program points.

- Customer Support Services: Provides quick access to support services, including live chat with Scotiabank representatives to resolve questions or issues.

- Enhanced Security: Incorporates advanced security features such as biometric authentication and verification codes to ensure the security of information and transactions.

What are the fees and interest on the Scotia Momentum card?

Understanding the fees and interest associated with using the Scotia Momentum Card is essential for any cardholder. These fees vary depending on different factors and card conditions. Let’s detail the main aspects:

Fees:

- Purchase interest rate: 19.99% per year;

- Cash advance interest rate: 22.99% per year;

- Interest rate on outstanding balances: 22.99% per year.

Taxes:

- Annual fee: CAD $99 per year (can be refunded if you spend at least CAD $50,000 on purchases on the card each year);

- Foreign Transaction Fee: None;

- Cash advance fee: $5 CAD or 2.5% of the advance amount, whichever is greater;

- Late Payment Fee: CAD $25;

- Return payment fee: CAD $45.

Other taxes:

- Card replacement: CAD $25;

- Paper card statement: CAD $2 per month.

How to unlock the Scotia Momentum card?

Unlocking the Scotia Momentum Card is a simple but important procedure that ensures the card’s security and readiness for use. We will detail the step-by-step process for unlocking the card after receiving it, including the necessary security checks.

- Receiving the Card: After the request is approved, the Scotia Momentum card will be sent by mail. Check that the card arrived in a sealed envelope with no signs of tampering.

- Read the Accompanying Instructions: Detailed instructions for unlocking are usually sent with the card. It is important to read these instructions carefully.

- Online or Telephone Verification: Card unlocking can be done online, via the Scotiabank website or app, or over the phone by calling the number provided in the instructions. These options allow the process to be carried out quickly and safely.

- Provide Security Information: During the unlocking process, you will be asked for security information to confirm the cardholder’s identity. This may include personal data, account information or specific card details.

- PIN (Personal Identification Number) Creation: If not already done, you will be asked to create a PIN for your card. This number will be used for ATM transactions and in-person purchases.

- Unblocking Confirmation: After providing all the necessary information and following the instructions, the card will be unlocked. An unlock confirmation will be provided, either via an online message or by voice if you are using the phone.

How do I request a duplicate of the Scotia Momentum card?

Requesting a duplicate of the Scotia Momentum Card is a straightforward procedure, especially important in cases of loss or theft of the card. Below is a step-by-step guide to requesting a new copy:

- Immediate Notification: If your card is lost or stolen, the first step is to immediately notify Scotiabank. This can be done via the mobile app, online via the bank’s website or over the phone.

- Data Confirmation: You will be asked for information to confirm your identity and account details. This step is crucial to ensure account security and prevent fraud.

- Request a New Copy: After confirming your identity, inform the attendant of the need to issue a second copy of the card.

- Old Card Blocking: Lost or stolen card will be blocked immediately to prevent unauthorized use.

- Request Confirmation: The bank will confirm the request for a new copy and provide information about the sending process.

The waiting time to receive your new card may vary, but Scotiabank generally strives to make it a quick process. In some situations, it may be possible to issue a temporary card while waiting for the new one to arrive.

Regarding costs, there may be a fee for issuing a second copy of the card. However, this fee may be waived in certain circumstances, such as in cases of theft with a police report. It is advisable to check with your bank for their current policies regarding these fees. By following these steps, Scotia Momentum Card holders can request a new copy of the card efficiently and securely.

How do I get in touch about the Scotia Momentum card?

If Scotia Momentum cardholders need to contact their bank for clarification, support or assistance, there are several options available. These include telephone, email and online chat. We will detail each of these options, as well as provide information about opening hours and tips for efficient support.

- Telephone: 1-888-882-8958;

- Scotia Mobile App: You can use the app to chat with a customer service representative or send a secure message;

- Online Chat: Available through the Scotia Bank website and the Scotia Mobile app.

Telephone customer service is usually available 24/7, especially for urgent issues like a lost or stolen card. Email and online chat may have specific hours of operation, which can be checked on the Scotiabank website.