TD Aeroplan card: How to request, Benefits, APP, Contact

Aeroplan is Air Canada’s loyalty program, offering members the opportunity to earn miles and redeem them for flights, upgrades, hotels, car rentals and much more. The TD Aeroplan, one of Canada’s most popular credit cards, allows you to earn Aeroplan miles with every purchase, as well as offering a number of exclusive benefits for travelers.

Advertising

Issued by Toronto-Dominion Bank (TD Bank), this card offers a variety of exclusive benefits and opportunities to earn Aeroplan points, which can be redeemed for airline tickets, class upgrades, hotel stays and much more.

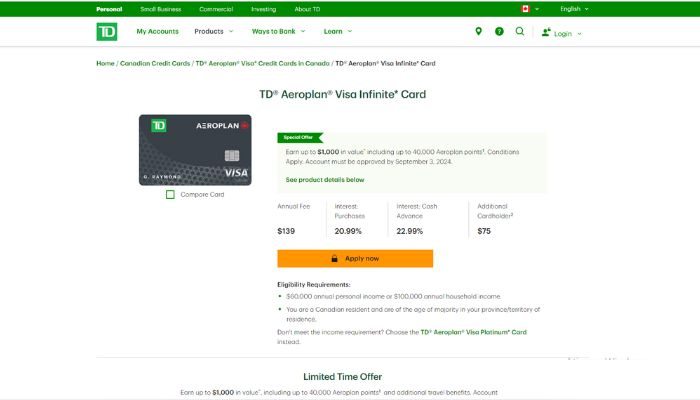

How to apply for the TD Aeroplan card

Advertising

To apply for the TD Aeroplan Credit Card, you need to follow a few simple but fundamental steps. First of all, it’s important to go to the official Toronto-Dominion Bank (TD Bank) website, where you’ll find detailed information about the financial products on offer, including credit cards.

Browsing the site is the first step to getting to know the features, benefits and requirements of the TD Aeroplan Card.

Advertising

- Visit the TD Website: Go to the official TD Bank website.

- Select the Card: Find and click on the TD Aeroplan Visa.

- Click on “Apply Now”: Start the application process.

- Fill Out the Form: Enter your personal and financial information.

- Review the Terms: Read the terms and conditions.

- Submit the Application: Click “Submit” to send your application.

- Wait for a Response: Wait for approval, which can be immediate or take a few days.

- Activate the Card: Follow the instructions to activate your card upon receipt.

Once you have familiarized yourself with the card and decided to proceed with the application, the next step is to find the section dedicated to applying for credit cards. This section is usually clearly indicated on the website and can be accessed easily. Once inside this section, you will see a list of the cards available, including the TD Aeroplan.

When you select TD Aeroplan as the option you want, you will be directed to an online application form. This form will ask for a variety of personal, financial and contact information. It is important to fill in all the information accurately and truthfully, as these details will be used by the bank to assess your eligibility for the card.

In addition to the application form, additional documents may be requested to support your application. These documents usually include proof of income, identification and residence. These documents can be sent online, uploaded or by other methods specified by the bank.

After submitting your application and documents, TD Bank will carry out an analysis to determine your eligibility for the card. This process can take a few days, during which the bank will assess your ability to pay, credit history and other relevant information. It is important to wait for the bank’s response before taking any further action.

Flag and Fees

- Flag: Visa, widely accepted worldwide;

- Annual fee: $120;

- Foreign transaction fee: 2.5%;

- Late payment fee: $10;

- Cash withdrawal fee: $5 + 25% of the amount withdrawn.

Main benefits of the TD Aeroplan Credit Card

The TD Aeroplan Credit Card, the result of a partnership between TD Bank and Air Canada’s Aeroplan program, offers travel-loving Canadians an exciting way to earn miles and enjoy exceptional rewards. If you’re looking for a credit card that rewards your passion for exploring the world and brings you closer to your dreams of flying, TD Aeroplan is the ideal choice.

With exclusive benefits and an incomparable loyalty program, the TD Aeroplan Card turns your travels into memorable experiences. Get ready to earn miles at every step, access VIP lounges at airports, enjoy premium travel insurance and much more. Dive into the world of travel with TD Aeroplan and explore the world with more rewards!

Benefits that elevate your travels:

Accelerated accumulation of Aeroplan miles: Earn 2 Aeroplan miles for every dollar spent on Air Canada flights, hotels booked through Aeroplan and supermarket purchases.

- Welcome bonus: Receive a welcome bonus of up to 50,000 Aeroplan miles, enough for a domestic round trip or an international one-way trip.

- Access to VIP lounges: Enjoy access to VIP lounges in selected airports around the world, providing comfort and exclusivity on your travels.

- Premium travel insurance: Protect yourself with comprehensive travel insurance, including medical insurance, trip cancellation insurance and lost luggage insurance.

- Exclusive offers and discounts: Explore offers and discounts on hotels, restaurants, car rentals and much more through the Aeroplan program.

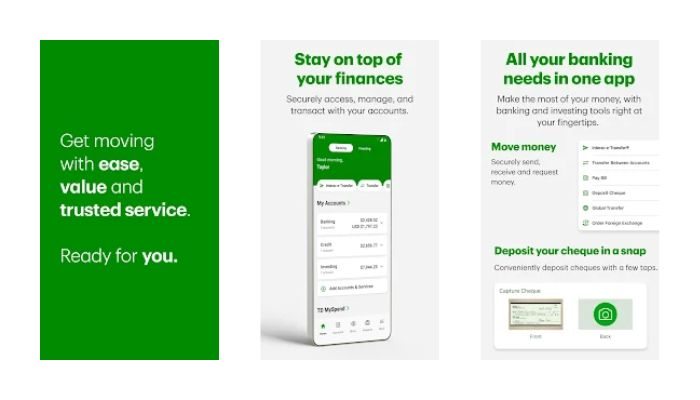

TD Aeroplan app

Download the TD Aeroplan app available for free on the App Store and Google Play to manage your account conveniently:

- Access your miles balance and track your progress towards your travel goals.

- View recent transactions and monthly statements.

- Pay your credit card bills with ease.

- Transfer Aeroplan miles to other program members.

- Redeem miles for incredible travel rewards.

Second copy of your TD Aeroplan Card: Solutions in case of loss or theft:

If your TD Aeroplan Card is lost or stolen, request a duplicate quickly and securely:

- Access the TD website: Log in to your TD Canada Trust online account and access the card management section.

- Select “Request a duplicate”: Choose the TD Aeroplan Card and click on “Request a duplicate”.

- Provide the necessary information: Enter your personal details and follow the instructions to request a new copy of your card.

- Receive the new card: TD Bank will send the new card to the home address registered on your account.

TD Aeroplan Customer Service

For any questions or assistance related to your TD Aeroplan Card, TD Bank offers several service channels:

- Telephone: Call 1-800-832-4323.

- Online chat: Visit the TD Canada Trust website and use the online chat to talk to a TD representative.

- TD Bank branches: Visit a TD Bank branch in your area for personal assistance.

The Citi Custom Cash Credit Card offers an attractive combination of benefits, including flexible cashback and customizable rewards, making it an excellent choice for those looking to maximize their earnings in spending categories that change monthly.

With a simple and straightforward application process, you can easily apply for this card and start enjoying its exclusive advantages. By following the step-by-step application guide, you will be on your way to enjoying all the benefits that the Citi Custom Cash Credit Card has to offer.