Wells Fargo Active Cash Card: How to request, Main benefits and other services

The Wells Fargo Active Cash Card is a financial tool that offers a number of benefits to its users. From cash rewards to purchase protections and advanced security, it stands out in the credit card market, providing perks that seek to meet the needs of modern consumers.

Advertising

Throughout this article, we will explore these benefits in detail, highlighting the main reasons to consider this card as a valuable option in the universe of means of payment.

How to Apply for the Wells Fargo Active Cash Card

Advertising

The Wells Fargo Active Cash card is a popular choice for those seeking a straightforward and rewarding cashback credit card. With unlimited 2% cashback on all purchases and no annual fee, this card is ideal for individuals who want to maximize their rewards without worrying about categories or limits.

Additionally, the Wells Fargo Active Cash card offers a generous sign-up bonus and various additional benefits, including cell phone protection and travel perks.

Advertising

In this guide, we will walk you through the process of applying for the Wells Fargo Active Cash card efficiently and smoothly.

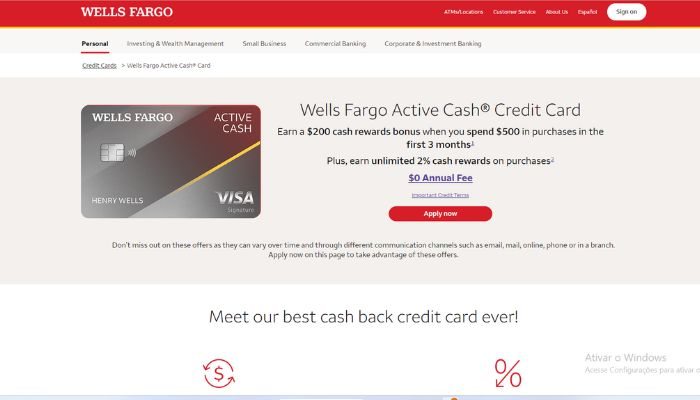

1. Visit the Wells Fargo Website:

- Open your browser and go to the official Wells Fargo website.

- Navigate to the credit cards section and select the Wells Fargo Active Cash card.

2. Check the Requirements:

- Review the eligibility requirements. Typically, you will need a good to excellent credit score to be approved.

3. Click on “Apply Now”:

- On the card’s page, click the “Apply Now” button to begin the application process.

4. Fill Out the Application Form:

- Enter your personal information, such as full name, address, and contact details.

- Provide financial information, including annual income and employment status.

- Enter details about your credit history.

5. Review the Terms and Conditions:

- Carefully read the card’s terms and conditions.

- Ensure you understand the fees, charges, and benefits associated with the Wells Fargo Active Cash card.

6. Submit the Application:

- After reviewing all the information, click “Submit” to send your application.

7. Wait for a Response:

- Wells Fargo typically provides a decision within minutes. In some cases, it may take a few days for a more detailed review.

8. Activate Your Card:

- If approved, you will receive your Wells Fargo Active Cash card in the mail.

- Follow the included instructions to activate your new card.

9. Start Earning Rewards:

- Use your Wells Fargo Active Cash card for all your purchases and start earning unlimited 2% cashback.

- Regularly check your cashback balance and explore redemption options on the Wells Fargo website.

By following these simple steps, you can apply for the Wells Fargo Active Cash card and enjoy all the benefits this straightforward and rewarding cashback card offers.

Wells Fargo Active Cash Card Benefits

The Wells Fargo Active Cash card has established itself as a popular option among consumers looking to maximize their financial transaction benefits. Here are some of the main benefits associated with this card:

- Cash Rewards: One of the most attractive features of the card is the ability to earn cash rewards for every purchase. These rewards can be redeemed in a variety of ways, such as invoice credit or account deposit.

- No Annual Fees: The absence of annual fees makes the card accessible to a wide range of users, ensuring savings over time.

- Purchase Protection: With this card, users have the peace of mind of having protections for their purchases. In cases of damage or theft of newly purchased items, there is coverage that can offer reimbursement.

- Advanced Security: Wells Fargo Active Cash comes with built-in security technologies to protect cardholder information and prevent fraudulent activity.

- Exclusive Offers: Card users often have access to exclusive promotions and offers, either for online purchases or at partner establishments.

- Quality Customer Service: Wells Fargo bank is known for its dedicated customer service, ensuring fast and efficient assistance for cardholders in case of questions or problems.

- Redemption Flexibility: In addition to redeeming cash rewards, cardholders have the option to use their accumulated points on a variety of categories, from travel to select products and services.

These are just a few of the many benefits that make the Wells Fargo Active Cash Card an attractive choice for consumers of all types. When considering its characteristics, it becomes evident why it is growing in popularity in the financial market.

Card interest and fees

Wells Fargo Active Cash offers an introductory interest rate of 0% for the first 15 months for both purchases and qualifying balance transfers. After that period, the variable interest rate can be 20.24%, 25.24% or 29.99%, depending on your credit profile. It is important to remember that there is a fee for balance transfers and that the interest rate on cash withdrawals is higher.

How to unblock the card

To unlock your Wells Fargo Active Cash card, you will need to activate it. Activation can be done quickly and easily via the Wells Fargo app, over the phone or on the bank’s website. During the activation process, you will be asked to create a password and follow the instructions provided. Once activated, your card will be ready to use.

How to check your card statement

Checking your Wells Fargo Active Cash bill is very simple. You can access your bill via the Wells Fargo app, the bank’s website or by phone. Through these channels, you will have access to a complete breakdown of all your purchases, payments and outstanding balance. In addition, you can pay your bill online, quickly and securely. To make it easier to keep track of your finances, you can have your invoice sent to you by e-mail.

The Wells Fargo Active Cash Card accept negatives?

Most major banks in the United States perform a credit check when you apply for a card. Generally, they look for a healthy credit history and are unlikely to approve applications from negative individuals. However, bank policies can change over time. It would be wise to check the Wells Fargo website or contact the bank directly for up-to-date information on their card approval policy.

Flag

Visa.

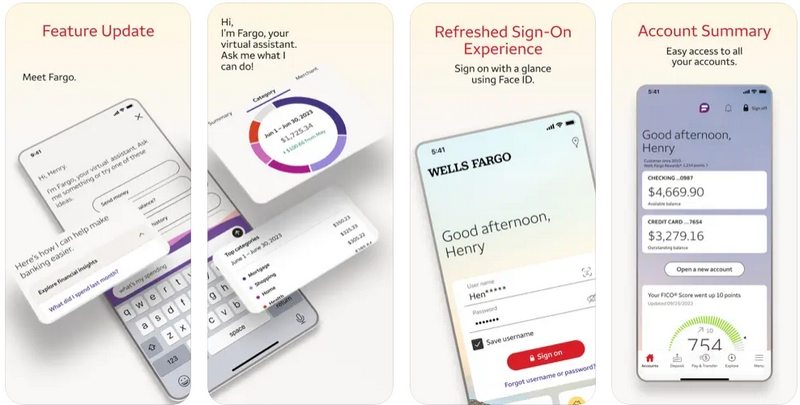

Wells Fargo APP

The Wells Fargo app allows cardholders to conveniently and securely manage their accounts. Through the app, you can:

- Check Balance and Statement: Users can view current balance, recent transactions and monthly statement.

- Make Payments: Offers the functionality to pay the card bill and other bills directly through the application.

- Configure Alerts: Allows users to configure notifications for specific activities, such as spending over a certain amount or payment reminders.

- Manage Rewards: For cards that offer rewards, the app provides a clear view of accumulated points and redemption options.

- Customer Service: Cardholders can contact the bank’s support team directly through the app.

- Security: Incorporates security measures such as biometric authentication and two-step verification to ensure that user information and transactions are protected.

The Wells Fargo app is an essential tool for those who want control and flexibility in managing their finances, all in the palm of their hand.

Wells Fargo Active Cash Card Contact

- Debit Cards: 1-800-869-3557

- Credit Cards: 1-800-642-4720

In conclusion, the Wells Fargo Active Cash Card offers a straightforward and rewarding option for those seeking financial benefits. With 2% unlimited cashback on all purchases and no annual fee, it stands out as an accessible choice.

Additional perks such as purchase protection, advanced security, and flexible redemption options make it a valuable tool for maximizing financial rewards. Apply for the Wells Fargo Active Cash Card today to start enjoying these benefits and enhance your financial management.