Wells Fargo Attune: Sustainable Lifestyle Credit Card

Wells Fargo is one of the most traditional and respected financial institutions in the United States, with a history dating back to 1852. Headquartered in San Francisco, California, the bank offers a wide range of financial services, including checking accounts, savings, loans, investments and credit cards. Recognized for its national presence and commitment to innovation, Wells Fargo serves millions of customers across the country.

Advertising

In 2024, the bank launched the Wells Fargo Attune World Elite Mastercard, a credit card designed to reward consumers who prioritize personal wellness, recreational activities and sustainable choices. This card stands out for its unique rewards categories and benefits geared towards a healthy and conscious lifestyle.

Meet the Wells Fargo Attune Card

Advertising

The Wells Fargo Attune World Elite Mastercard is an innovative credit card launched by Wells Fargo in 2024, designed to reward consumers with active, conscious lifestyles who are engaged in personal and environmental well-being. With a focus on spending categories that promote health, entertainment and sustainability, Attune stands out by offering unlimited cash rewards of 4% on selected purchases, with no annual fee. This proposition is especially attractive to C-class consumers in the United States, who are looking to maximize their financial benefits in categories that align with their interests and values.

In addition to financial rewards, Wells Fargo Attune also stands out for its commitment to social responsibility. By qualifying for the $100 cash rewards bonus, the cardholder also contributes to a $50 donation to Capital Link, a non-profit organization that supports health centers and clean energy initiatives. This integrated approach to financial benefits and social impact makes Attune an attractive choice for consumers who want their spending to reflect their personal values.

Advertising

Main Benefits of the Wells Fargo Attune Credit Card

Before listing the specific benefits, it’s important to understand the consumer profile that Wells Fargo Attune aims to serve. This card is ideal for individuals who value a healthy, sustainable and conscious lifestyle. Its benefits are designed to reward spending in categories that promote personal well-being and a positive impact on the environment.

Now, let’s explore the main benefits offered by the Wells Fargo Attune:

- Cash Rewards: 4% on select categories such as wellness, sports, recreation and sustainable purchases; 1% on other purchases.

- Welcome Bonus: $100 in cash rewards when you spend $500 in the first 3 months.

- Charity Donation: $50 donated to Capital Link when you qualify for the welcome bonus.

- Cell Phone Protection: Up to $600 in case of damage or theft, when the cell phone bill is paid with the card.

- Travel and Lifestyle Services: Access to concierge services and exclusive travel benefits.

- Credit Score: Free access to your FICO® Score every month.

How to Apply for the Wells Fargo Attune Credit Card

Applying for the Wells Fargo Attune is a simple and straightforward process, designed to be accessible even to those who are applying for a credit card for the first time. The process can be done online, over the phone or in person at a Wells Fargo branch. To get started, you’ll need to provide personal information, such as your full name, address, Social Security number and annual income. In addition, the bank will perform a credit analysis to determine the applicant’s eligibility.

A convenient option is to check for pre-approval for the Attune card, which can increase the chances of approval by providing an indication of qualification prior to formal application. Wells Fargo offers a pre-qualification tool on its website, where you can check eligibility without negatively impacting your credit score. Upon approval, the card will be sent to the address provided, usually within a few business days.

Bankrate

Step by Step to Apply for the Wells Fargo Attune Card

- Go to the Official Website: Visit wellsfargo.com/attune to start the application process.

- Click on “Apply Now”: Start your application by clicking on the button indicated.

- Complete the Application Form: Provide your personal and financial information as requested.

- Review and Submit Your Application: Check all the data and submit your application for review.

- Wait for Approval: Wells Fargo will review your application and, if approved, send the card to the address provided.

Expert Opinions on the Wells Fargo Attune Card

Financial and credit experts have rated the Wells Fargo Attune positively, highlighting its generous rewards and exclusive benefits. According to Bankrate, the Attune offers high rewards rates in unconventional categories and a solid set of benefits for a card with no annual fee. Among the benefits highlighted are cell phone protection, liability waivers for fraudulent purchases and concierge services, all provided by Mastercard World Elite.

WalletHub also praises Attune, especially for consumers with credit scores over 750, who spend significantly in categories such as personal care, entertainment, pet expenses and sustainable purchases. The card offers cash rewards of 1% to 4%, with no annual fee, and includes benefits such as cell phone protection and travel assistance.

However, experts warn that Attune may not be suitable for all consumers. FinanceBuzz notes that the card does not offer high rewards in traditional categories such as supermarket and restaurants, and that the standard interest rate after the promotional period can be high. In addition, the card charges a 3% foreign transaction fee, which can be an inconvenience for those traveling internationally.

Therefore, the Wells Fargo Attune is highly recommended for consumers who prioritize personal well-being, entertainment and sustainable choices, and who spend significantly in these areas. For those who do not fit this spending profile, it may be more advantageous to consider other credit card options that offer rewards in broader categories and more competitive interest rates.

Card Flag

The Wells Fargo Attune is issued under the Mastercard banner, specifically the World Elite version. This guarantees access to a range of exclusive benefits, including special offers, access to VIP lounges at airports and personalized concierge assistance.

Wells Fargo Attune Card Fees

- Annual fee: $0.

- Foreign Transaction Fee: 3%.

- Balance Transfer Fee: $5 or 3% of the amount transferred, whichever is greater, for the first 120 days; after that, the fee is 5% or $5, whichever is greater.

- Cash Advance Fee: $10 or 5% of the amount, whichever is greater.

- APR for Cash Advance: 29.99% variable.

- Penalty Fees: None.

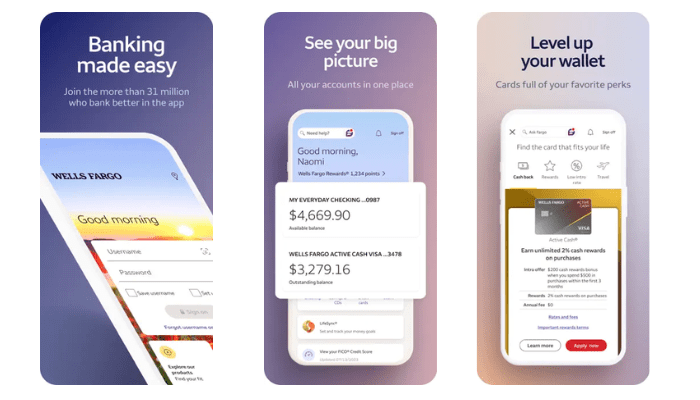

How to Download the Wells Fargo Attune Credit Card App

To manage your account and rewards, download the Wells Fargo Mobile® app:

- iOS: Available on the App Store.

- Android: Available on Google Play.

Once downloaded, log in with your Wells Fargo credentials to access your account.

How to request a duplicate Wells Fargo Attune credit card

If you’ve lost or had your card stolen, request a duplicate:

- Online: Log in to your Wells Fargo account and request a replacement card.

- Phone: Call customer service and ask for a duplicate.

- Branch: Visit a Wells Fargo branch and apply in person.

The new card will be sent to your registered address.

Wells Fargo Attune Credit Card Contacts

- Customer Service: 1-800-642-4720.

- Website: wellsfargo.com/attune.

- Mobile App: Available for iOS and Android.

The Wells Fargo Attune World Elite Mastercard is an excellent choice for consumers looking for a credit card that focuses on rewards for a healthy, sustainable lifestyle and personal well-being. With its generous 4% rewards in specific categories and no annual fee, the card is ideal for those who value a balance between financial benefits and positive social impact.

However, as with any financial product, it’s important to consider your spending profile before applying for the card. If your spending habits align with the categories offered by Attune, it can be an excellent tool for maximizing your rewards while contributing to meaningful causes.